Alternative Data on Balance Looks Weaker

- The shutdown enters its 21st day marking the second longest on record. The record-holding 2018-2019 shutdown appears in danger of falling as Polymarkets is betting it goes well into November and Congressional action on the matter seems lifeless (see graph below). By the way, November 5th would mark a new record. In the meantime, we search for alternative data points where we can find them until the hastily assembled September CPI report due on the newly named Inflation Friday. Meanwhile, Treasury yields continue to slip quietly lower. Currently, the 10yr Treasury is yielding 3.96%, down 1bp on the day, while the 2yr note yields 3.45%, also down 1bp in early trading.

- As the government shutdown and data blackout continues our search for alternative data points continues and one of those sources are the regional Fed activity surveys. As the Fed is independently funded it’s not subject to the government budgetary blockade so they continue to issue data that may be limited in scope but still provides some clues while we scud run below the low cloud base squinting for an opening. In that regard, the latest from the Philly Fed’s October Non-Manufacturing Activity Survey wasn’t that great. By way of background, the monthly survey tracks insights from business owners, executives, and managers in the Third Fed District, which comprises central and eastern Pennsylvania, southern New Jersey, and Delaware. Survey responses were collected from Oct. 6-16.

- The index of general business activity for firms slowed 3.6 in October from 5.8 in September. The index doesn’t measure the size of the change, but measures how many firms say things are getting better versus worse. General business activity for the region decreased to -22.2 in October, from -12.3 in September (see graph below). The reading suggests the ISM Services PMI, due November 5, could contract for the first time since May after it hovered near neutral in September.

- In addition, new orders fell almost 18 points to -17.4, the first negative reading since June. Sales fell to -2.4 in October from 17.9 in September, the lowest level since May. The employment index fell 13.9 points to -4.5, the weakest since April. Meanwhile, indicators suggest more moderate price pressures than recent months.

- Another alternative data point is our somewhat estranged neighbor to the north, Canada. Their government continues to operate and produce monthly economic statistics. Now, we don’t mimic the Canadian economy but given the close relationship between the two countries, even with the current round of contretemps, it does give us a feel for what we may be missing in the shutdown. Thus, Canada just released their September CPI data, and the YoY level came in at 2.4% vs. 1.9% in August and expectations of 2.2%. The core median rate was unchanged at 3.2% but that’s two-tenths above the 3.0% expectation. So, while we expect to get our September CPI this Friday, the canary in the coalmine that is Canada is signaling some risk of a higher-than-expected print.

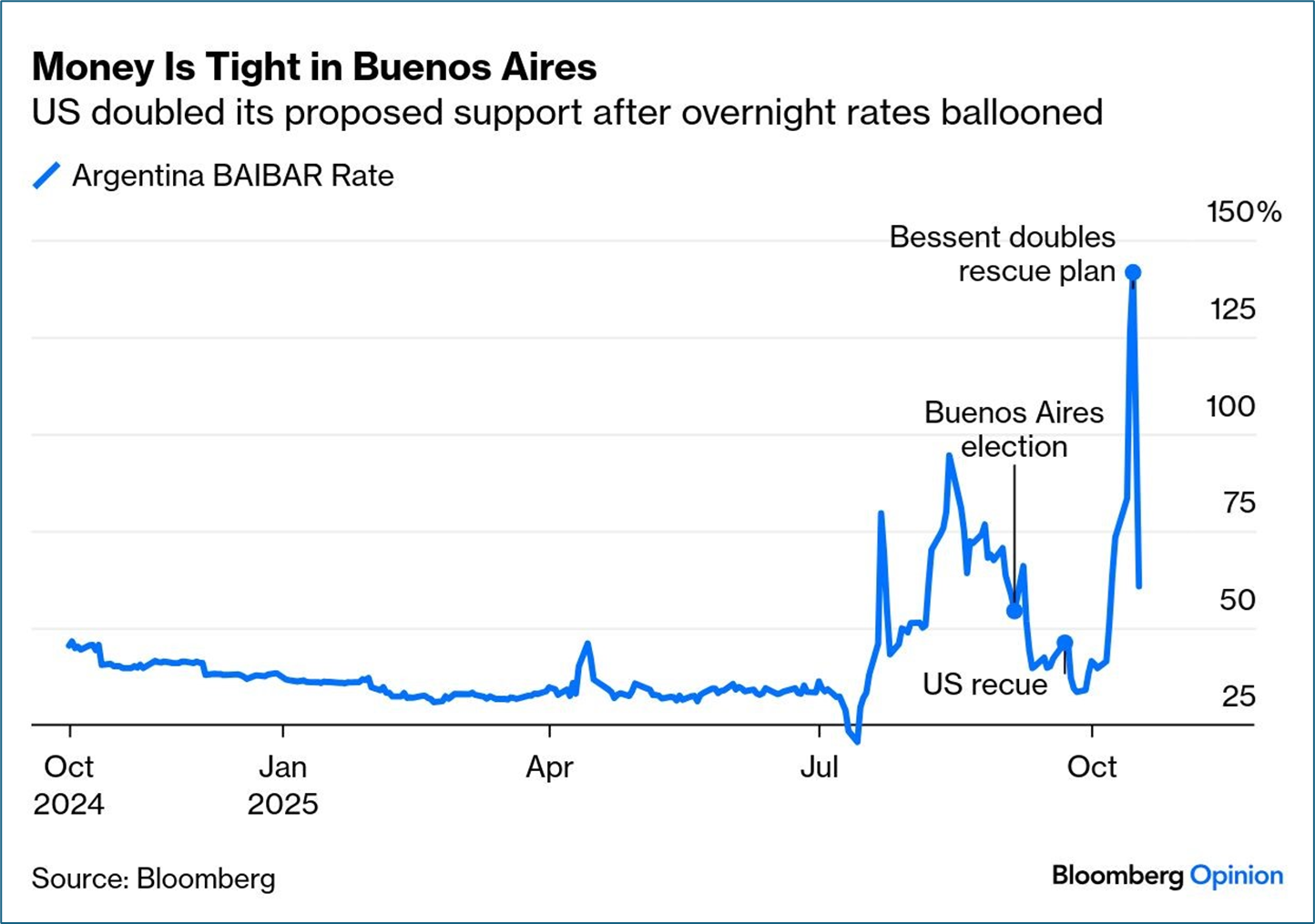

- One of the side stories that intrigues us is the US assistance to Argentina as President Milei struggles to maintain control over his economic program to cut spending and restore some stability to prices and the peso. The US has agreed to supply a $20 billion swap line, which was quickly doubled to $40 billion, giving Argentina funds to fight currency flight and depreciation which threatens higher inflation and damage to Milei as parliamentary elections approach this weekend. The controversial US aid to a foreign country, over pleas for assistance from US soybean farmers and cattle ranchers struggling under Trump’s tariff regime, has so far failed to stabilize the peso or assist Milei in his party’s prospects for the upcoming election. Trump has said he would desist with US assistance if Milei’s party, La Libertad Avanza, fares poorly in the Sunday elections so the risks are large.

Philly Fed Non-Manufacturing Survey – Activity Slowed in October

Canada CPI vs. US CPI – Canadian Uptick in September Exceeded Expectations

Securities offered through the SouthState | DuncanWilliams 1) are not FDIC insured, 2) not guaranteed by any bank, and 3) may lose value including a possible loss of principal invested. SouthState | DuncanWilliams does not provide legal or tax advice. Recipients should consult with their own legal or tax professionals prior to making any decision with a legal or tax consequence. The information contained in the summary was obtained from various sources that SouthState | DuncanWilliams believes to be reliable, but we do not guarantee its accuracy or completeness. The information contained in the summary speaks only to the dates shown and is subject to change with notice. This summary is for informational purposes only and is not intended to provide a recommendation with respect to any security. In addition, this summary does not take into account the financial position or investment objectives of any specific investor. This is not an offer to sell or buy any securities product, nor should it be construed as investment advice or investment recommendations.