After Strong Employment Report, Inflation Week Greets Investors

- Treasury yields are inching ever-so-slightly higher this morning as the post-jobs report skittishness continues, albeit with much less impetus than last Friday. Also, investors are no doubt nervous with a trio of inflation reports looming on the horizon, along with retail sales on Thursday. So, the week is full of catalysts for even higher yields if the numbers are hotter than expected. Currently, the 10yr Treasury is yielding 4.78%, up 1bp on the day, while the 2yr is yielding 4.41% up 1bp from Friday’s close.

- After the strong employment report there’s no rest for investors as the attention this week quickly turns to the latest inflation numbers. This month, PPI kicks things off tomorrow, followed by CPI on Wednesday, and Import/Export Prices on Thursday. The question for investors is will that trio of inflation reports throw gas on the fire started by the hot employment numbers, or will they provide a bit of salve to the burns suffered on Friday? And if that wasn’t enough potential kindling, we get the Retail Sales Report on Thursday for the latest read on the all-important consumer’s spending habits. Suffice it to say, if the market is looking for reasons to continue the sell-off, both stocks and bonds, there will be plenty of potential catalysts between now and Friday.

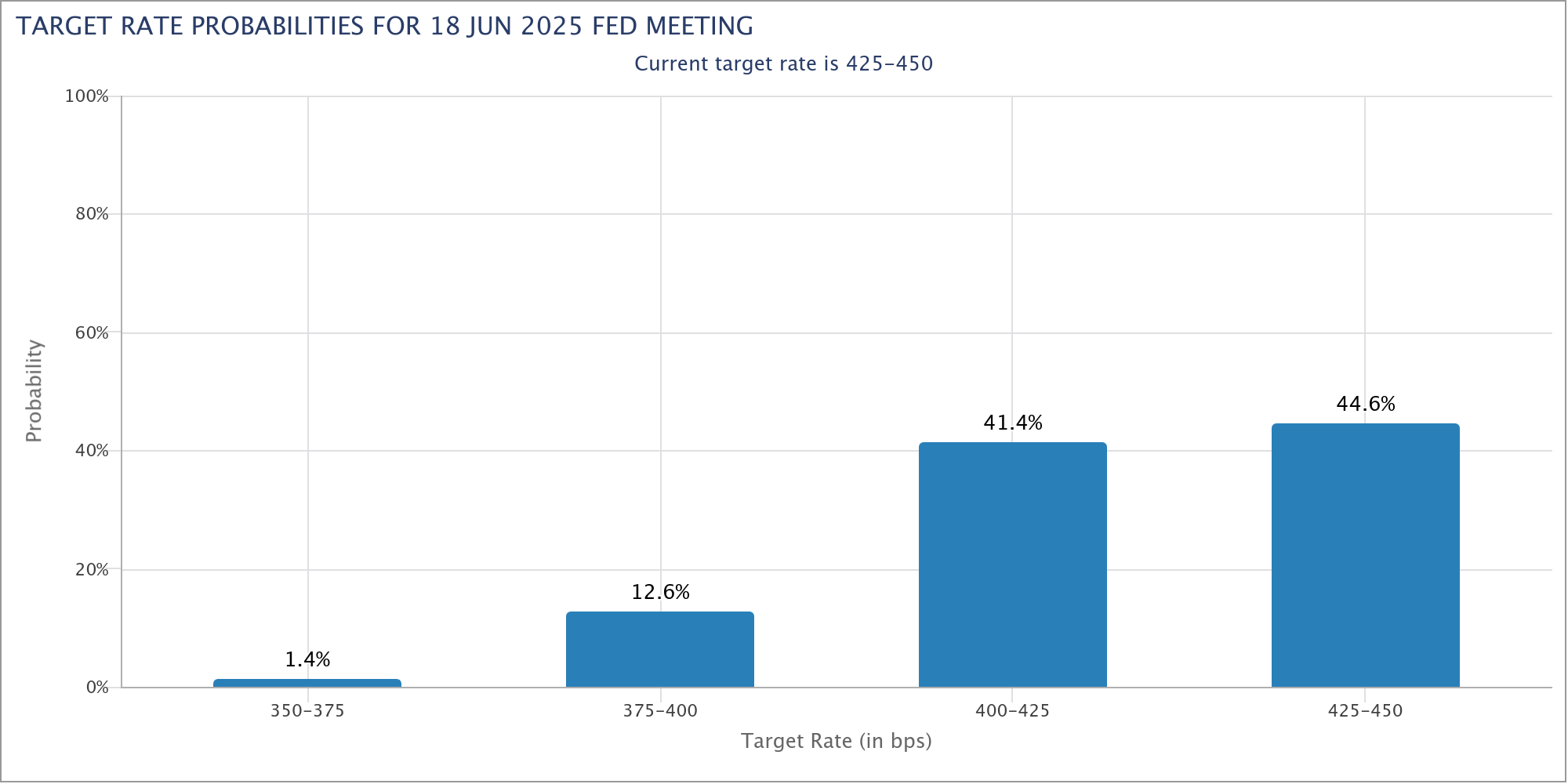

- With the December jobs report behind us, the market is anxious to see if the inflation numbers add to the bearish tone for rate cuts that the strong employment report provided. While futures markets trimmed odds for a June rate cut after the labor market data, odds still point to the June meeting, but that may be it for the year according to futures(see graph below).

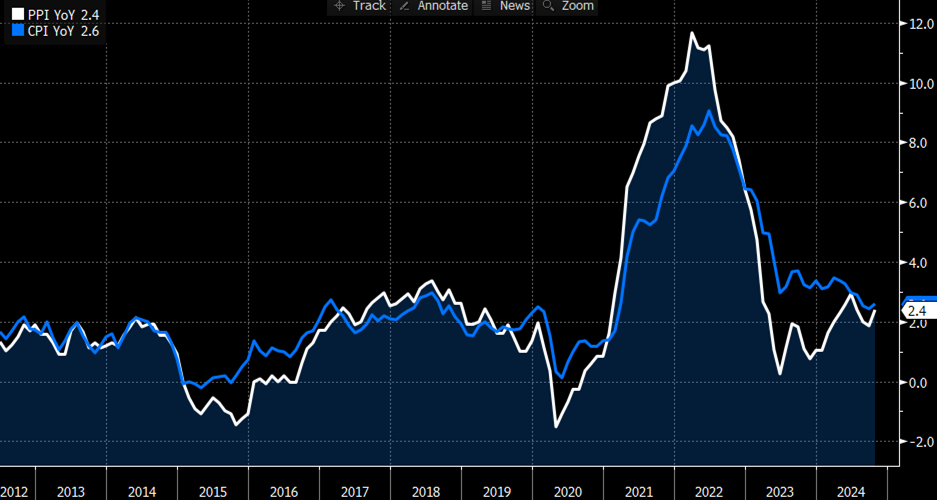

- PPI will be the first inflation data out of the gate tomorrow with 0.4% MoM gain expected, matching November’s gain, with the YoY Final Demand rate remaining unchanged at 3.0%. The core PPI rate (ex-food and energy) is expected to increase 0.3% vs 0.2% in November with the YoY rate increasing from 3.4% to 3.5%. We’ve mentioned before the tailwinds from mid-2022 through mid-2023 when wholesale prices were dropping rapidly. That has ended with prices grinding higher since mid-2023. That reversal of lower wholesale prices flowing to retail will be another headwind for CPI as it tries to cover that last mile to the 2% target (see graph below).

- The December CPI will follow on Wednesday with expectations for core CPI to increase 0.2% MoM with the YoY rate stable at 3.3%. A 0.3% print, or higher, will likely pressure yields higher as investors brace for a long period of pause. The usual suspects to a higher print, Owner’s Equivalent Rent (OER) and core services ex-housing will be key here. The long-awaited rollover in OER has been frustratingly uneven but it did tick down in November to pre-pandemic levels. Will that continue or will its erratic behavior resume? Fed Governor Christopher Waller, in an address last week, was optimistic about inflation returning to trend and that it’s primarily the difficult to measure “imputed” price inputs, like OER, that have kept the overall rate elevated. If it is OER that causes a hot reading will markets wave it off as Waller is apparently willing to do? We’re not so sure, especially considering the jittery mood they will be in this week.

- While not as consequential as the first two inflation reports, the Import/Export Price Report will certainly get some attention on Thursday. The November report was rather friendly for both import and export prices, but with the threat of tariffs looming, is it the calm before the storm?

- Finally, retail sales for December will be the last of the key reports for the week. Overall sales are expected to increase 0.5% vs. 0.7% in November with the less volatile sales ex-auto and gas up 0.3% vs. 0.2% in November. Recall, the November headline gain was driven by a strong showing in car sales, perhaps replacing flooded vehicles from the Sept/Oct. storms. While that’s not likely to repeat in December an uptick in core sales will indicate the consumer is not retrenching yet, which could be another bearish headwind to yields.

Wholesale Prices Continue to Edge Higher Which Will Be Another Headwind for Further CPI Improvement

Source: Bloomberg

Securities offered through the SouthState | DuncanWilliams 1) are not FDIC insured, 2) not guaranteed by any bank, and 3) may lose value including a possible loss of principal invested. SouthState | DuncanWilliams does not provide legal or tax advice. Recipients should consult with their own legal or tax professionals prior to making any decision with a legal or tax consequence. The information contained in the summary was obtained from various sources that SouthState | DuncanWilliams believes to be reliable, but we do not guarantee its accuracy or completeness. The information contained in the summary speaks only to the dates shown and is subject to change with notice. This summary is for informational purposes only and is not intended to provide a recommendation with respect to any security. In addition, this summary does not take into account the financial position or investment objectives of any specific investor. This is not an offer to sell or buy any securities product, nor should it be construed as investment advice or investment recommendations.