After So-So Employment Report, Inflation Week is Next

- Treasury yields are mostly unchanged this morning as investors nervously await a trio of inflation reports this week. Also, investors will be keen to see how the consumer fared in January with retail sales on Friday. In addition, the ever-present risk of tariff announcements from the White House will keep the bulls at bay for the time being. Currently, the 10yr Treasury is yielding 4.49%, unchanged on the day, while the 2yr is yielding 4.27%, down 1bp on the day.

- After the so-so employment report there’s no rest for investors as attention quickly turns to the latest inflation numbers. CPI kicks things off Wednesday, followed by PPI on Thursday, and Import/Export Prices on Friday. The question for investors will be if the higher prints we say in the first quarter last year repeat themselves in 2025. If so, that will certainly play into the lengthy pause expected before the next rate cut. And if that wasn’t enough to chew on, we get Retail Sales on Friday representing our first look at the consumer in January. \

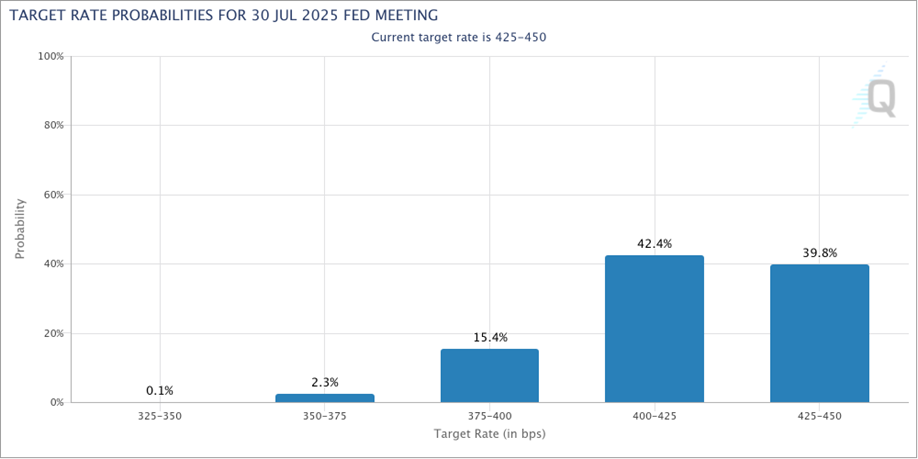

- With the January jobs report behind us, the market is anxious to see if the inflation numbers add to the bearish tone for rate cuts that the employment report provided. Futures markets trimmed odds for a June rate cut after the labor market data, with a first cut shifting from June to July (see graph below).

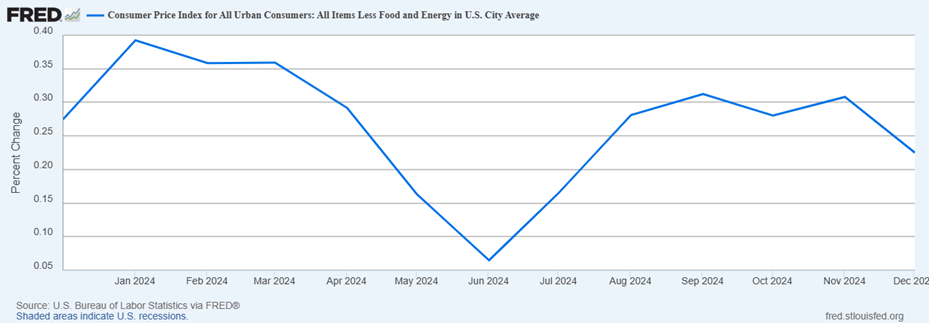

- CPI will be the first inflation data out of the gate Wednesday with a 0.3% MoM gain expected vs December’s 0.4% gain, with the YoY rate remaining unchanged at 2.90%. Core CPI (ex-food and energy) is expected to also increase 0.3% vs 0.2% in December with the YoY rate decreasing from 3.2% to 3.1%. The usual suspects to a higher print, Owner’s Equivalent Rent (OER) and core services ex-housing will be key here. The long-awaited rollover in OER has been frustratingly uneven but it did tick down for a second straight month in December into pre-pandemic levels. Will that continue or will its erratic behavior resume? The good news is that last year we saw a trio of 0.4% MoM prints (ok, 0.356% unrounded) in the first quarter (see graph below), so anything less will nudge the YoY rate lower.

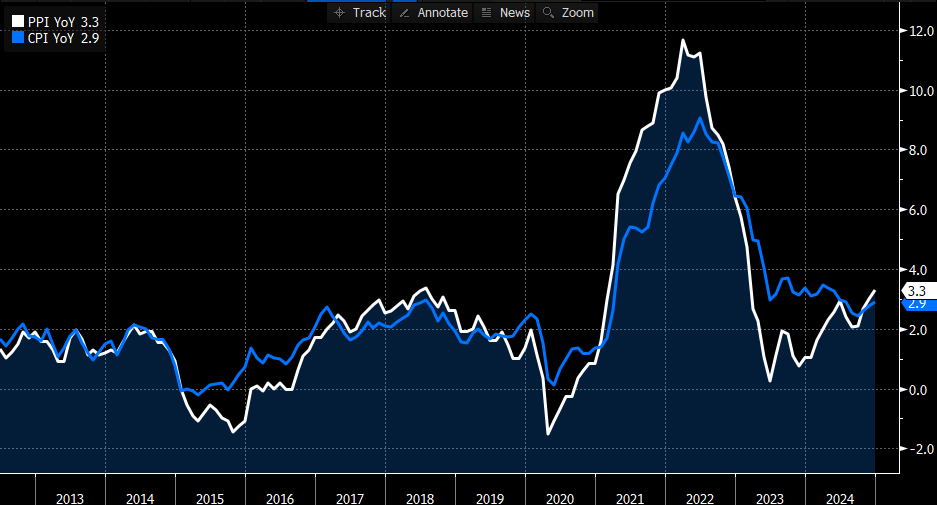

- January PPI will follow on Thursday with expectations for overall PPI to increase 0.3% MoM vs. 0.2% in December with the YoY rate stable at 3.3%. The core rate (ex-food and energy) is expected to also print at 0.3% print MoM, with the YoY rate ticking a tenth lower to 3.4% from 3.5% in December. We’ve mentioned before the tailwinds from mid-2022 through mid-2023 when wholesale prices were dropping rapidly. That has ended with prices grinding higher since mid-2023. That reversal of lower wholesale prices flowing to retail will be another headwind for CPI as it tries to cover that last mile to the 2% target (see graph below).

- While not as consequential as the first two inflation reports, the Import/Export Price Report will certainly get some attention on Friday, especially with all the tariff talk lately. The December report was rather friendly for both import and export prices, but the expectation is for a pop in import prices (0.4% MoM) while export prices are expected up 0.3% MoM, same as December.

- Finally, retail sales for January will be the last of the key reports for the week. Overall sales are expected to be flat vs. 0.4% in December with the less volatile sales ex-auto and gas up 0.4% vs. 0.3% in December. Recall, November’s strong headline gain (0.7%) was driven by a strong showing in car sales, perhaps replacing flooded vehicles from the Sept/Oct. storms. While December didn’t match that strength at 0.4% it was still a solid month so some pausing by the consumer after Christmas is not totally unexpected. Anything below expectations, however, and the fear of a retrenching consumer, especially after the weaker consumer confidence numbers, will get the Fed’s attention.

Wage Gains in Jobs Report Push Odds for First Rate Cut From June to July FOMC Meeting

Wholesale Prices Continue to Edge Higher Which Will Be Another Headwind for Further CPI Improvement

Source: Bloomberg

In the First Quarter of 2024, Core CPI (MoM) Printed Above 0.35% – Anything Lower This Year Should Force YoY Rate Lower

Securities offered through the SouthState | DuncanWilliams 1) are not FDIC insured, 2) not guaranteed by any bank, and 3) may lose value including a possible loss of principal invested. SouthState | DuncanWilliams does not provide legal or tax advice. Recipients should consult with their own legal or tax professionals prior to making any decision with a legal or tax consequence. The information contained in the summary was obtained from various sources that SouthState | DuncanWilliams believes to be reliable, but we do not guarantee its accuracy or completeness. The information contained in the summary speaks only to the dates shown and is subject to change with notice. This summary is for informational purposes only and is not intended to provide a recommendation with respect to any security. In addition, this summary does not take into account the financial position or investment objectives of any specific investor. This is not an offer to sell or buy any securities product, nor should it be construed as investment advice or investment recommendations.