ADP Surprises with Job Losses in September

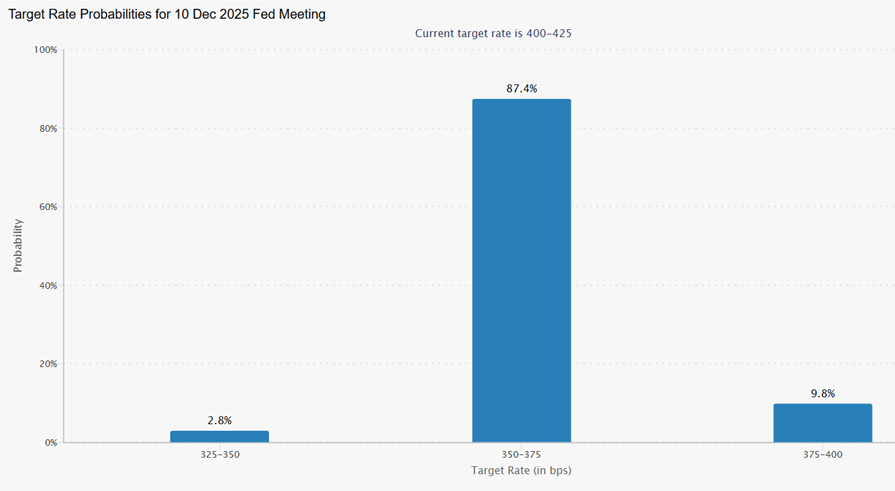

- While we may not see a BLS Nonfarm Payrolls Report on Friday, the ADP Employment Report provided plenty of labor-related news to keep everyone busy in the meantime. ADP surprised with job losses for September, mostly due to benchmarking revisions stemming from the same report that generated the BLS revisions for August. We discuss the ADP numbers in more detail below but suffice it to say that it has yields lower and odds of multiple FOMC rate cuts higher. Currently, the 10yr Treasury is yielding 4.10%, down 5bps on the day, while the 2yr note yields 3.54%, down 6bps in early trading.

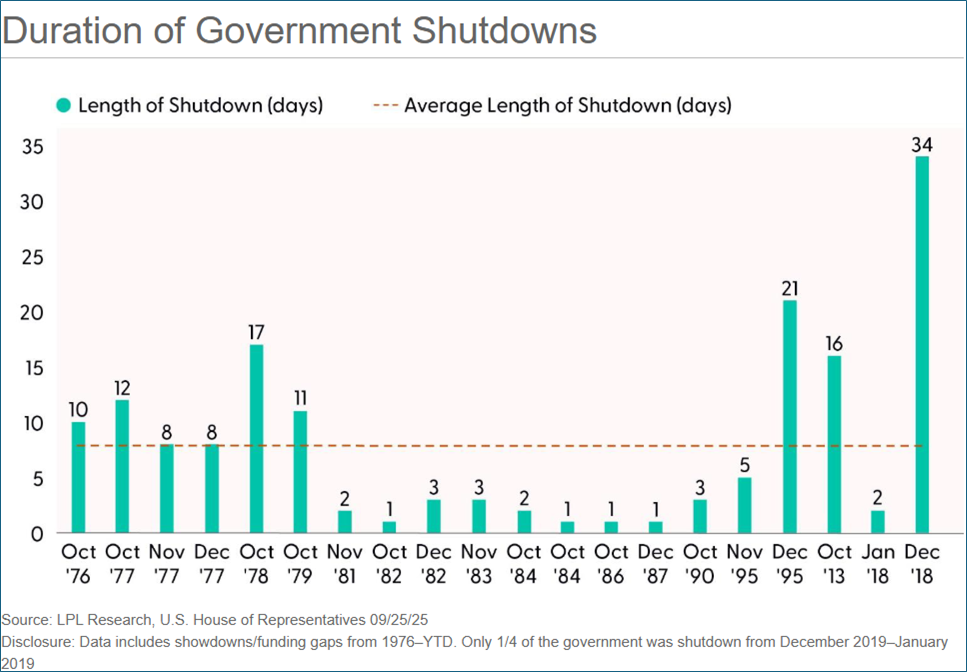

- The government shutdown is upon us and for this week, at least, the biggest worry for our readers will be what economic reports will be delayed. As far as this week is concerned, the impacted reports will be Initial Jobless Claims and Friday’s BLS jobs numbers for September.

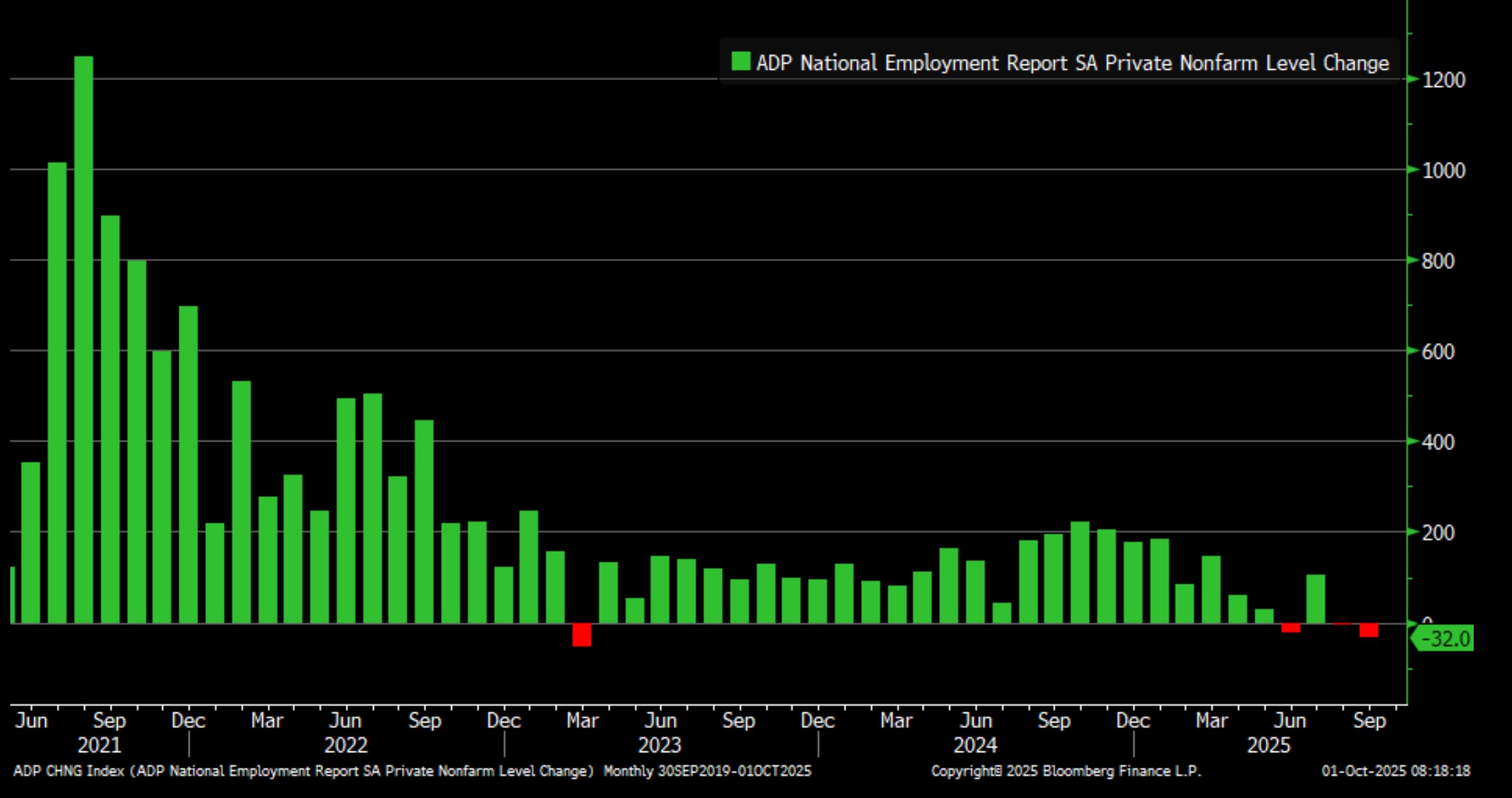

- In any event, we did receive the September ADP Employment Change Report this morning and it surprised to the downside by -32 thousand which missed expectations of 50 thousand new private sector jobs and down from a revised loss of 3 thousand jobs in August. This miss is, in part, impacted by the recent BLS revisions.

- For September, ADP conducted its annual preliminary re-benchmarking based on the full-year 2024 results of the Quarterly Census of Employment and Wages, the same report that drove the BLS revisions. This recalibration resulted in a reduction of 43,000 jobs in September compared to pre-benchmarked data. That is, without the benchmarking process ADP would have reported 11 thousand new private sector jobs, which are still well below the 50 thousand expectation and the 54 thousand new jobs initially reported in August. The August print was adjusted down to -3 thousand from the same benchmarking process.

- The service sector took the brunt of losses totaling 28 thousand while the goods producing sector lost 3 thousand jobs. By region, the Midwest suffered 63 thousand lost jobs while the Mid-Atlantic states gained 19 thousand jobs, and the Pacific states gained 21 thousand jobs. So, clearly the distribution of jobs was positive on the coasts and negative in the heartland. Firm size showed a clear difference too. Small (-50k) and medium size firms (-20k) suffered losses while large firms gained 33 thousand jobs. Small is defined as <50 workers, medium 50 – 499 workers, and large 500+. Clearly, the smaller firms are finding it difficult to adjust to the trade-related policies and have stepped back as a result. Annual pay gains were like previous months with job-stayers receiving 4.5% annual pay hikes and job-leavers at 6.6%.

- It’s estimated that with reduced immigration numbers, that the current equilibrium rate to keep the unemployment rate steady is around 50 thousand new jobs per month. Keep in mind, with government now shedding jobs the private sector losses only add to the unemployed totals such that the unemployment rate will begin to climb in the months ahead.

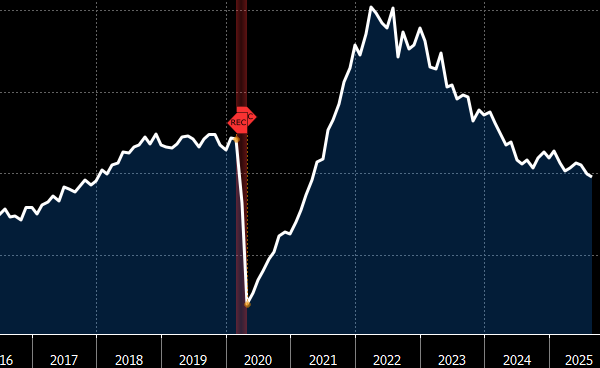

- Meanwhile, the Job Openings and Labor Turnover Survey for August was released yesterday and while the headline job openings number slightly beat expectations (7.227 million vs. 7.200 million expected and 7.208 million in July), the internals were still indicative of a slowing labor market. The jobs-to-jobless ratio fell again to 0.98 from 1.00, the lowest since April 2021.

- The Quits Rate, (voluntary separations/total employed), a measure of worker confidence in finding employment, declined) from 2.0% to 1.9%, matching the lowest since the pandemic. The Hiring and Layoff Rates were close to unchanged for the month, indicating little movement in hiring and layoff patterns. While hiring levels are down, and remain down, layoffs aren’t moving noticeably higher which is like what we’re seeing in the weekly jobless claims series.

- The Conference Board also reported its consumer confidence readings for September yesterday and confidence trailed the prior month and expectations (see graph below). The Present Situation and Expectations readings also ticked lower and the labor differential metric (jobs easy to find – jobs hard to get) fell again to 7.8 from 11.1 in August. This represents the biggest monthly drop since April, and the lowest print since February 2021. Just another indication of flagging labor momentum.

- The ISM Manufacturing Index for September will also be released later this morning with the headline measure expected to remain just below the Mendoza Line (IYKYK) of 50 at 49.0 vs. 48.7 in August indicating the sector remains short of expansion territory. The Prices Paid Index, and the Employment Index will get plenty of attention as the dual Fed mandates of price stability and full employment get an airing, at least from the manufacturing sector. Given the ADP numbers, it looks like the group worried about the labor market is holding the upper hand right now.

ADP Employment Change Report Following Annual Benchmarking Revisions

JOLTS Has Job Openings Less Than Unemployed for Second Straight Month

Source: JOLTS

After ADP, Futures See High Odds of 2 More Rate Cuts this Year

Source: CME Group

Securities offered through the SouthState | DuncanWilliams 1) are not FDIC insured, 2) not guaranteed by any bank, and 3) may lose value including a possible loss of principal invested. SouthState | DuncanWilliams does not provide legal or tax advice. Recipients should consult with their own legal or tax professionals prior to making any decision with a legal or tax consequence. The information contained in the summary was obtained from various sources that SouthState | DuncanWilliams believes to be reliable, but we do not guarantee its accuracy or completeness. The information contained in the summary speaks only to the dates shown and is subject to change with notice. This summary is for informational purposes only and is not intended to provide a recommendation with respect to any security. In addition, this summary does not take into account the financial position or investment objectives of any specific investor. This is not an offer to sell or buy any securities product, nor should it be construed as investment advice or investment recommendations.