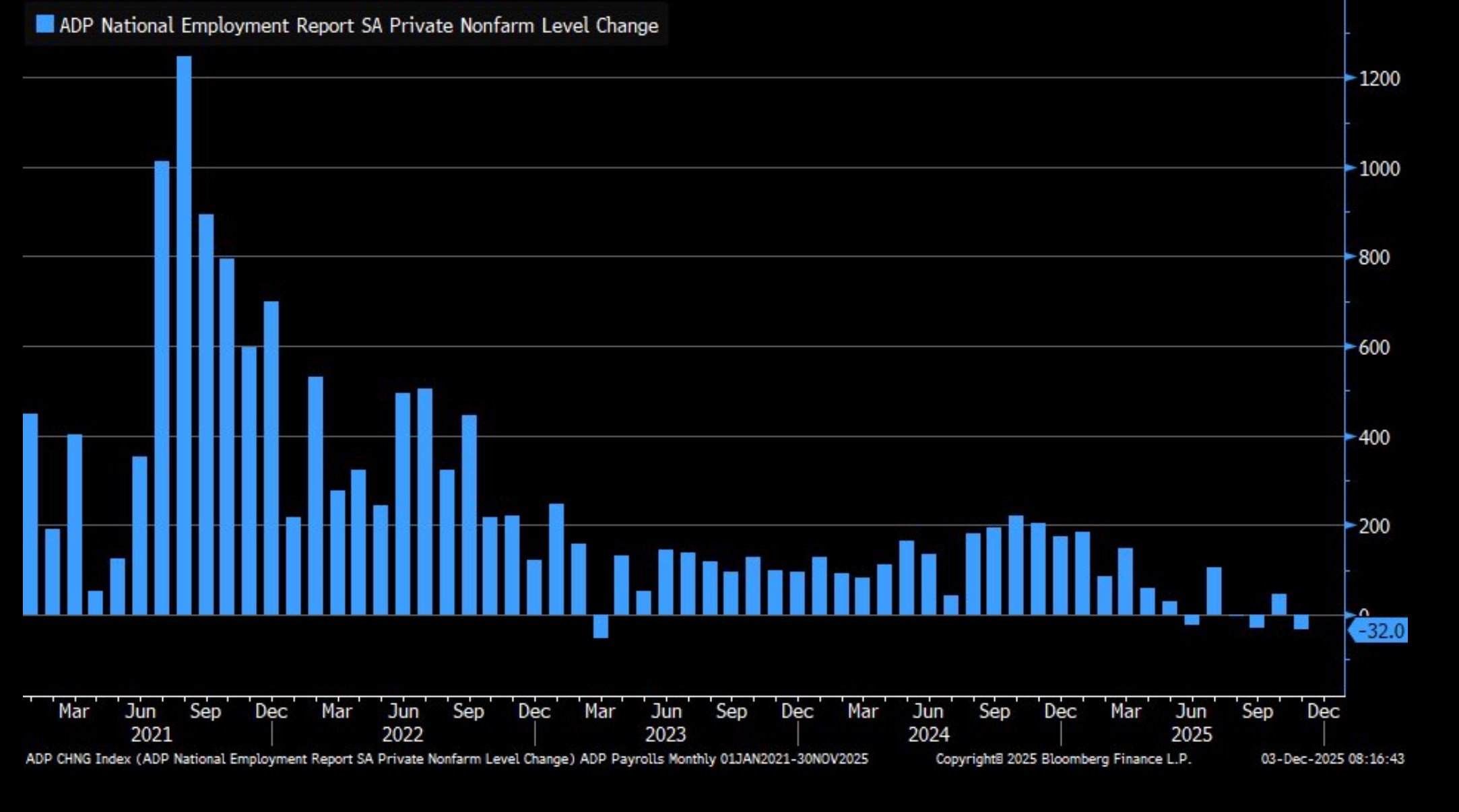

ADP Reports 32K in November Job Losses

- If you were thinking the economy was taking a step back while the government shutdown prevented updated data, the ADP Employment Change Report for November confirmed your thinking. ADP reported 32k in job losses in November (more on that below) and that continues to solidify the consensus for a rate cut next week. Odds that the new Fed Chair will be Kevin Hassett increased yesterday with President Trump expected to officially announce his pick early next month. With Hassett expected to push for frequent rate cuts, it’s keeping the back end under some pressure but that’s being offset today by the weakening economic updates. Currently the 10yr Treasury is yielding 4.06%, down 3bps on the day, while the 2yr note yields 3.48%, down 4bps in early trading.

- The November ADP Employment Change Report was just released with a loss of 32 thousand private sector jobs vs. 42 thousand in October. Expectations were for an increase of 10 thousand jobs, but with the weekly updates during November indicating job losses there was a fair amount of angst heading into the number. The deficit was largest in professional/business services (-26k), information tech (-20k), and manufacturing (-18k). Job gains were greatest in education/health services (+33k). In an unmistakable sign of the struggles with tariffs the smallest firms saw the greatest job losses with firms under 50 employees losing 120k jobs with mid-size (50 -499 employees) and large firms (>500 employees) gaining 51k and 39k, respectively. By region, the northeast (-100k) and south (-43k) suffered the greatest declines with the west gaining the most (+67k).

- Annual wage gains for job-stayers were 4.4% vs. 4.5% in October while job-changers saw annual wage gains of 6.3% vs. 6.7% the prior month. These wage rates have been generally stable during the year but well off the mid-7% levels back in 2022 and 2023. With the release of the BLS Nonfarm Payrolls Report for November delayed until Dec. 16th this report will garner a decent amount of focus despite its loose correlation with the government’s results.

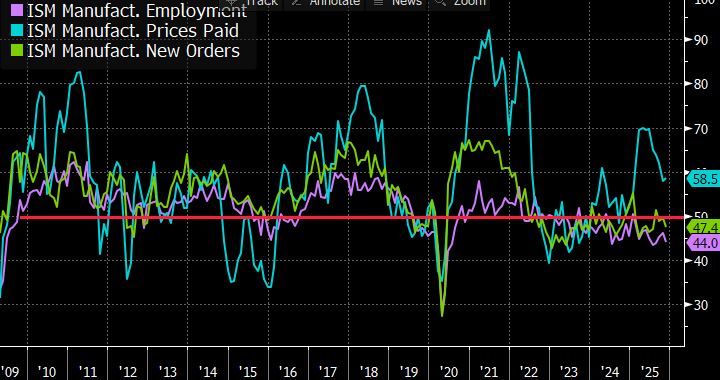

- At 10am ET, the November ISM Services Report will be released with expectations for the index to be relatively unchanged at 52.0 vs. 52.4 in October. Just like with Monday’s manufacturing numbers, the Prices Paid, New Orders, and Employment indices will get plenty of attention given the delayed BLS reports. The ISM Manufacturing release disappointed across-the board (see graph below), but something similar in the services survey, which is a much larger slice of the economy, will set off alarm bells at the Fed, so stay tuned for those results.

- The September Import and Export Price Index was also released this morning with import prices unchanged MoM vs. 0.1% in August. Expectations were for prices to increase 0.1%. The YoY rate was unchanged at 0.3%, slightly under the 0.4% expectation. This is the last piece of data needed for the September PCE inflation series which will be released on Friday. Expectations there are for a benign 0.2% MoM increase in the core measure with the YoY rate down a tenth to 2.8% vs. 2.9% in October. Export prices for September were also unchanged vs. a 0.3% rise in August. The YoY rate increased to 3.8% from 3.4% the prior month. This is a benign report and shouldn’t shift the expectations for the September PCE due on Friday.

- It’s not all gloom, however, as TSA boarding levels hit a yearly peak on Sunday with 3.134 million passengers passing through security screening. Now, the Sunday after Thanksgiving is often the busiest day of the year, so Sunday’s results aren’t that much of a surprise, but Sunday’s peak travel bested the peak levels from the recent past (see graph below). That signals that the K-shaped economy continues. Those upper income consumers are still traveling in great numbers, but is their consumption enough to carry an economy where there is an increasing number that are struggling? So far, the answer has been yes, but for how much longer?

ADP November Employment Change Report – Notice a Trend?

ADP Employment Report – Smaller Firms Suffer Most Losses Source: ADP

Source: ADP

ISM Manufacturing Survey for November – Not Much Good to Say  Source: ISM

Source: ISM

TSA Boardings Hit New Cycle High Last Sunday – Evidence the K-Shaped Economy Continues

Source: TSA

Securities offered through the SouthState | DuncanWilliams 1) are not FDIC insured, 2) not guaranteed by any bank, and 3) may lose value including a possible loss of principal invested. SouthState | DuncanWilliams does not provide legal or tax advice. Recipients should consult with their own legal or tax professionals prior to making any decision with a legal or tax consequence. The information contained in the summary was obtained from various sources that SouthState | DuncanWilliams believes to be reliable, but we do not guarantee its accuracy or completeness. The information contained in the summary speaks only to the dates shown and is subject to change with notice. This summary is for informational purposes only and is not intended to provide a recommendation with respect to any security. In addition, this summary does not take into account the financial position or investment objectives of any specific investor. This is not an offer to sell or buy any securities product, nor should it be construed as investment advice or investment recommendations.