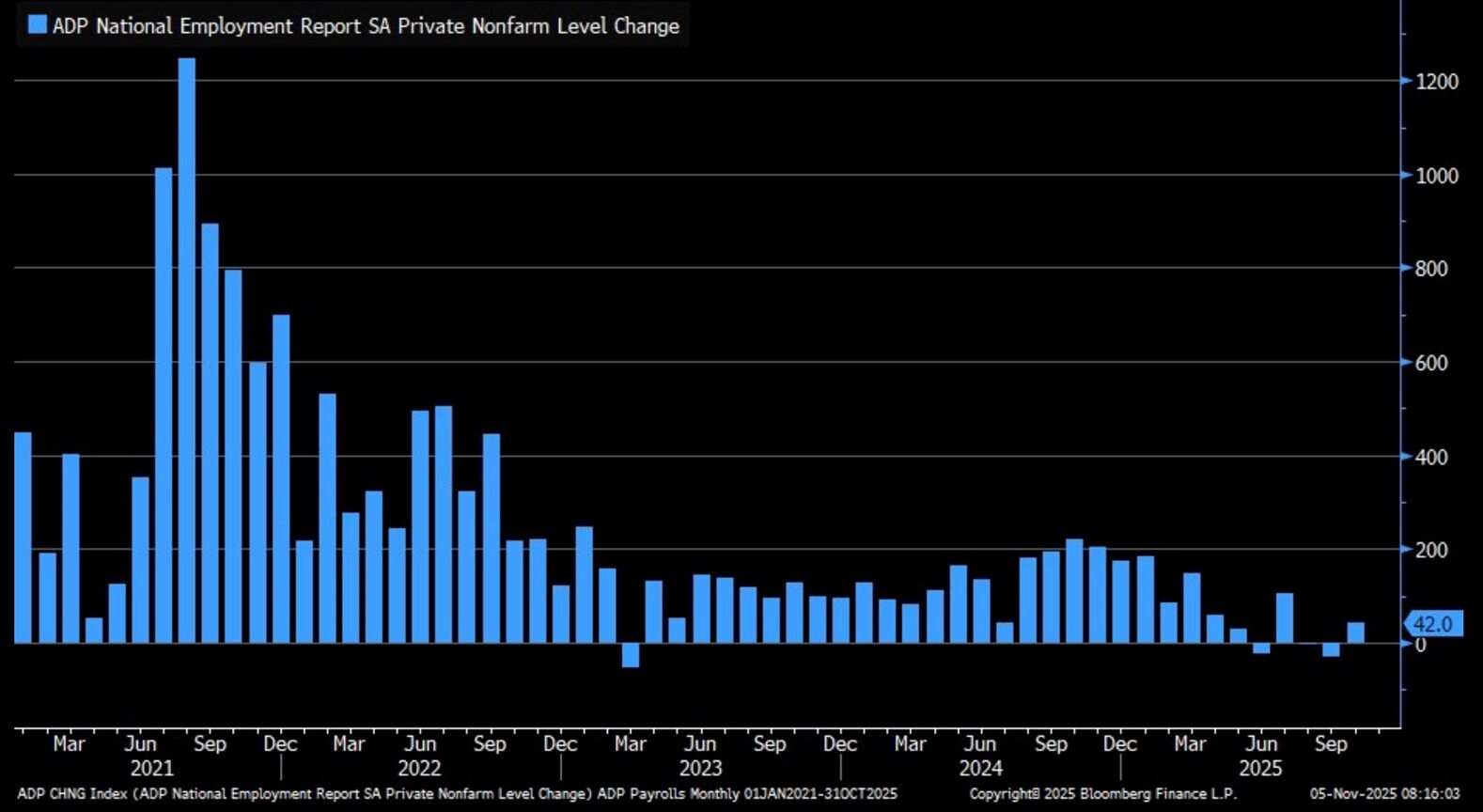

ADP Rebounds with Job Gains in October

- While we won’t have a BLS Nonfarm Payrolls Report on Friday, for the second straight month, the privately issued ADP Employment Report provided plenty of labor-related news this morning. ADP, after surprising with job losses in September, beat expectations in October (read more below). The ISM Services Index for October will be the next report this morning at 10am ET, with job and inflation numbers for the market to ponder. Currently, the 10yr Treasury is yielding 4.11%, up 2bps on the day, while the 2yr note yields 3.59%, up 1bp in early trading.

- In any event, we did receive the October ADP Employment Change Report this morning and it beat expectations with 42 thousand private sector jobs vs. 35 thousand expected. The one-month reversal is not astounding but certainly better than the -29 thousand jobs lost in September, which was after a loss of 3 thousand jobs in August.

- The service sector, which took the brunt of losses in the prior two months, rebounded with 33 thousand new jobs (mostly in trade/transportation/utilities), while the goods producing sector gained 9 thousand jobs (mining and construction led the way). By region, the Pacific states led with 40 thousand jobs while Mid-Atlantic states lost 20 thousand jobs. A clear shift in the east/west divide. Firm size showed a clear difference too. Small (-10k) and medium size firms (-21k) suffered losses while large firms gained 73 thousand jobs. Small is defined as <50 workers, medium 50 – 499 workers, and large 500+. This pattern is becoming a trend with smaller firms obviously finding it more difficult to adjust to tightened immigration and ever-shifting trade policies and have stepped back on employment as a result. Annual pay gains remain similar to recent months with job-stayers receiving 4.5% annual pay hikes and job-leavers at 6.7%.

- Meanwhile, the ISM Manufacturing Index for October was released on Monday and it was a big meh. The headline measure remained below 50 at 48.7 vs. 49.1 in September indicating the sector remains short of expansion territory. The Prices Paid Index did improve from 61.9 to 58.0 but still pricey but the lowest reading since January. The Employment Index improved slightly from 45.3 to 46.0 but still short of an expanding sector. So, call it a mediocre at best read on the manufacturing sector in October. It should be noted too that the comments section of the report was dominated by tariff uncertainty concerns that both are increasing input costs and stalling projects given the heightened uncertainty.

- The ISM Services Index for October will be released at 10am ET with a slight improvement expected from 50.0 to 50.7. The service sector is much larger than manufacturing (approx. 90% vs. 10%) and has been the source of economic and labor market strength during the recovery from the brief pandemic recession. Any backsliding towards contraction while manufacturing remains so-so will be another arrow in the quiver for FOMC members leaning towards a rate cut in December. The prices paid (69.4 in Sept.), employment (47.2) and new orders (50.4) will garner attention for further fleshing out of the state of services.

- The Treasury is expected to announce today the composition of auction sizes for the coming three months with $569 billion in total expected to be issued, which is down $21 billion from an earlier estimate. Coupon auction sizes are expected to remain the same with any increase coming from T-Bill issuance, as Bessent tries to limit interest expense by keeping coupon auction sizes unchanged. This should also help to mitigate supply indigestion.

- Last but not least, at last week’s Evolve Banking Forum, I sat down with Dr. Elliot Eisenberg, one of our guest speakers at the conference, where we talked about the economy and his outlook for 2026. He’s quite the entertaining guy in the field of economics so give this 20-minute discussion a listen. The link is here.

ADP Rebounds with Job Gains in October

Source: ADP

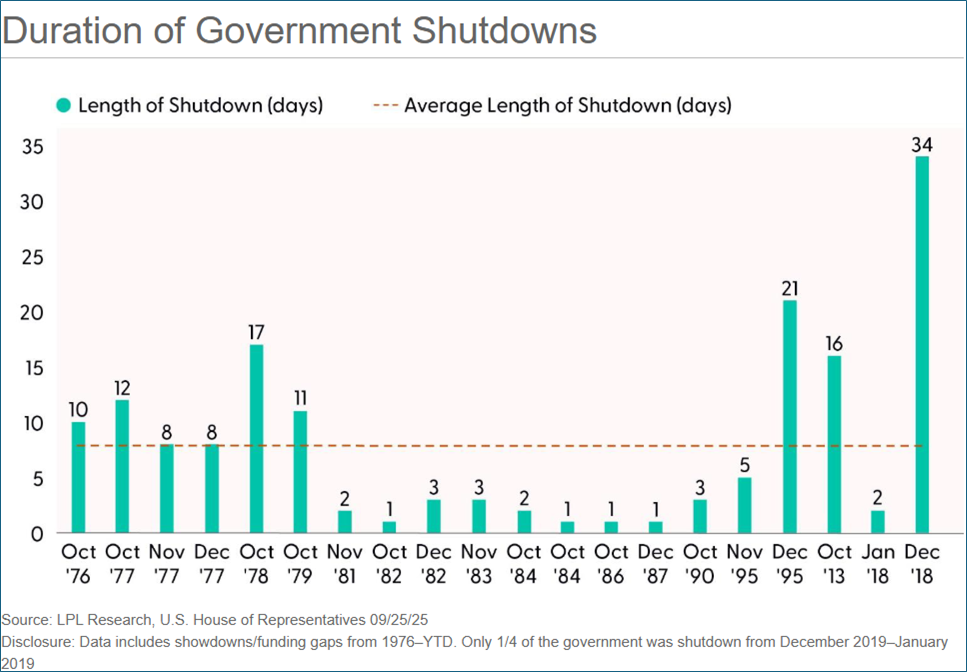

At 36 Days and Counting We’re at a New Shutdown Record

Securities offered through the SouthState | DuncanWilliams 1) are not FDIC insured, 2) not guaranteed by any bank, and 3) may lose value including a possible loss of principal invested. SouthState | DuncanWilliams does not provide legal or tax advice. Recipients should consult with their own legal or tax professionals prior to making any decision with a legal or tax consequence. The information contained in the summary was obtained from various sources that SouthState | DuncanWilliams believes to be reliable, but we do not guarantee its accuracy or completeness. The information contained in the summary speaks only to the dates shown and is subject to change with notice. This summary is for informational purposes only and is not intended to provide a recommendation with respect to any security. In addition, this summary does not take into account the financial position or investment objectives of any specific investor. This is not an offer to sell or buy any securities product, nor should it be construed as investment advice or investment recommendations.