ADP Job Growth Disappoints in May

- Treasury yields are lower on the heels of a disappointing ADP Employment Change Report for May which adds even more drama to the Friday BLS Nonfarm Payrolls Report. President Trump wasted no time after the release in calling for Fed Chair Powell to begin rate cuts now. So much for a quiet Wednesday! Currently, the 10yr is yielding 4.40%, down 6bps on the day, while the 2yr is yielding 3.91%, down 4bps.

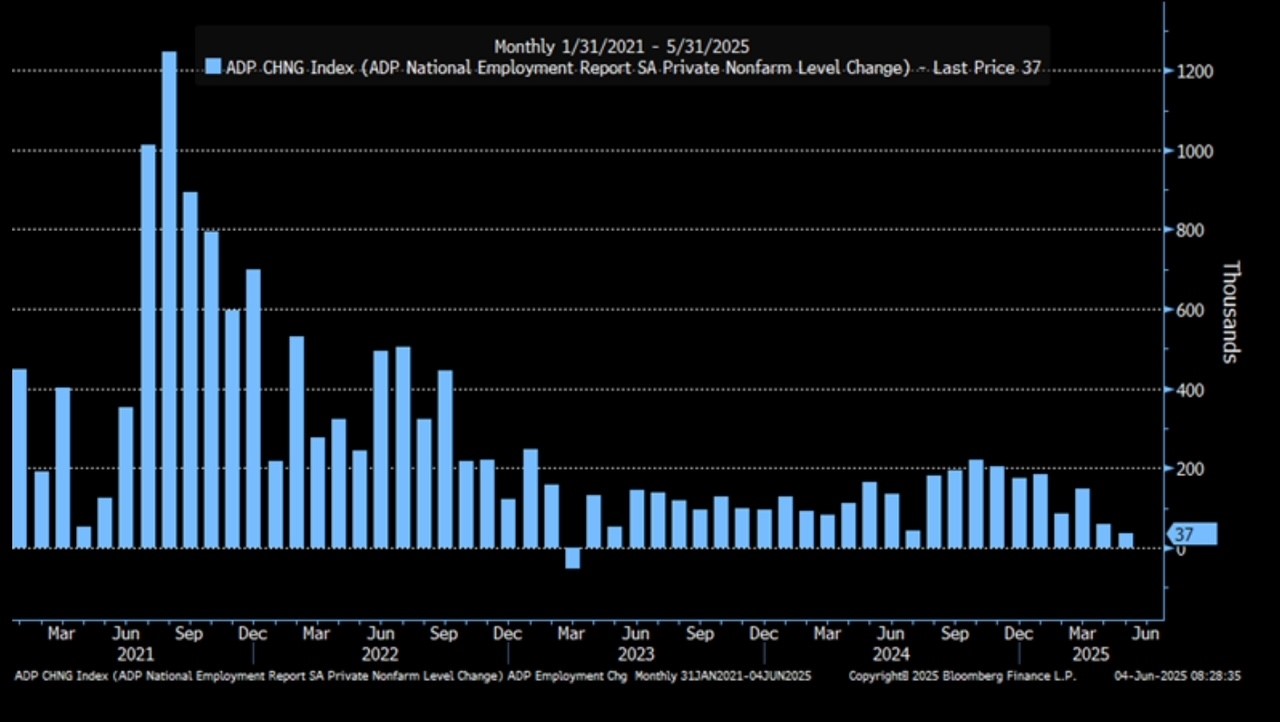

- The ADP Employment Change Report was released this morning with 37 thousand private sector jobs for May vs. 110 thousand expected and 60 thousand in April (revised down from 62 thousand). It’s the lowest monthly gain since 2023 and of ADP’s five different company size segments only mid-sized firms (50 – 249 workers) saw an uptick in job growth at 51 thousand. Small firms were particularly hard hit with job losses which makes sense in that smaller firms have less ability to work around higher tariff costs and the resulting business impact. One bit of good news in the release was that annual wage gains remained solid with job-stayers at 4.5% and job-leavers at 7.0%. The Friday BLS Nonfarm Payroll Report is expected to see 115 thousand private sector jobs vs. 167 thousand in April. While ADP has a poor track record in forecasting the BLS number, the overall trend is pretty clear with slowing momentum in the labor market but so far in an orderly manner.

- At 10am ET we’ll get the ISM Services Survey for May with a slight improvement expected (52.3 expected vs. 51.6 in May). The ISM Manufacturing numbers on Monday indicated a sector still in contraction (48.5 vs. 48.7 April) with not much positive movement in orders, employment or prices paid. While the services sector has carried the economy for the past couple years the expectation is that the momentum is slowing and that is the expectation for May.

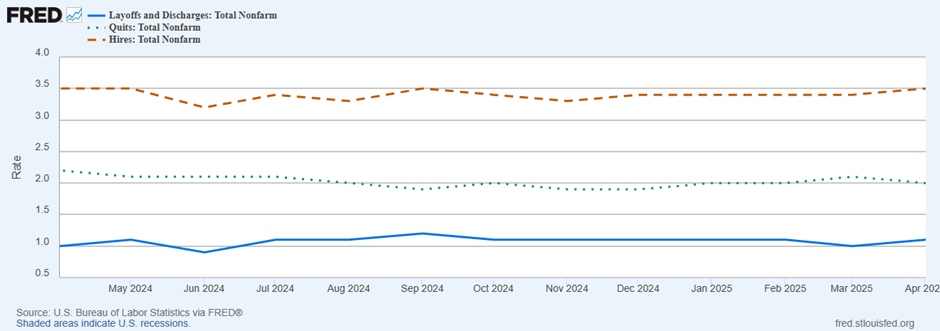

- The Job Openings and Labor Turnover Survey (JOLTS) was expected to reflect continued cooling in labor market conditions but not raise alarm bells either. That’s about what was delivered. Job openings rose to 7.491 million in April vs. 7.192 million in March. That kept the job openings to jobless ratio near the 1.0 level which is a far cry from the labor market tightness in 2022 when the ratio peaked at 2 job openings for every unemployed person. The Quits Rate (voluntary separation divided by total employed) retreated a bit (2.0% vs. 2.1%), while the Layoffs Rate ticked a bit higher from 1.0% to 1.1%. No Wiley Coyote off the cliff moment but momentum continues to slow in the labor market but in an orderly fashion, for now.

- The final look at Durable Goods Orders for April were released yesterday and mostly matched the advance read from last week. Headline orders were down -6.3% with orders less transportation up 0.2%. The proxy for business equipment orders (non-defense, ex-air orders) was down -1.5% vs. -1.3% in the initial estimate. Shipment of non-defense, ex-air goods remained at -0.1%. So, a quiet month for durable goods orders and that is expected given the tariff uncertainty that has been swirling about and that’s not likely to change in the near-term.

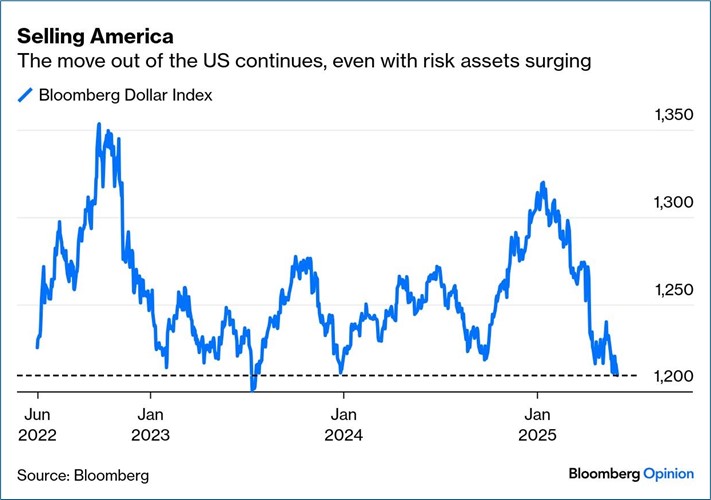

- As the market grapples with the latest labor market data, it’s also trying to game out whether the American Exceptionalism trade is over. This theory revolves around the idea that the US has historically provided above-average returns and a stable and transparent legal foundation, allowing the US to enjoy the benefits of being the world’s reserve currency. However, the recent drop in the dollar in the face of rising yields and stocks is an anomaly not often seen in developed countries, but it is what we’ve been experiencing since the tariff issue sprang into being. That has analysts concerned whether foreign investors are beginning to put their sizeable capital elsewhere.

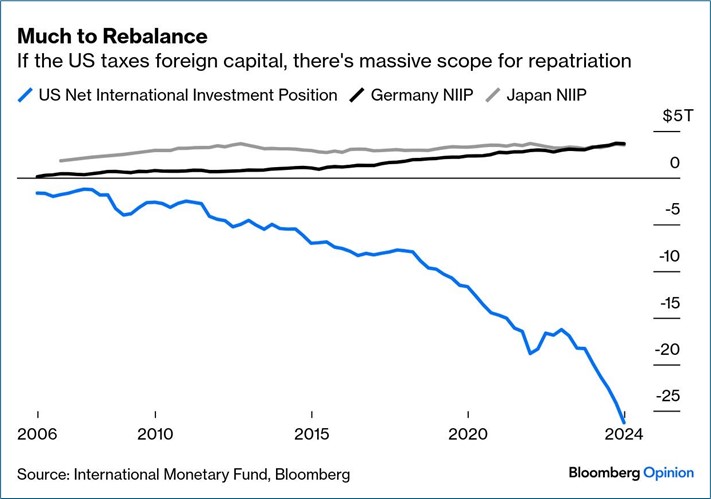

- In addition, buried in the budget bill, that now sits in the Senate after being approved in the House, is Section 899 which allows for a tax on foreign investors if it’s determined that their home country has applied “discriminatory taxes” on American companies. The digital services tax levied by the EU on several large tech firms (think Meta, Google, Apple, and Amazon) seems to be the catalyst for this section. In any event, it allows for a tax on foreign investment starting at 5% with a cap of 20%.

- If this section remains in the final legislation foreign investors may opt to move at least a portion of their US investments elsewhere which would make the capital flight issue that much more relevant (see graphs below). So far, recent Treasury auctions don’t indicate a rush to the exits by foreign money but with the dollar’s recent decline it does have markets worrying whether the era of easy, low-yielding money may be about to change.

ADP Employment Change Report – Lowest Job Growth Since March 2023

April JOLTS: Nothing Dramatic but Quits Rate Edges Lower While Layoffs Rate Edges Higher

US Dollar Hitting Key Support Level – Will it Hold?

Plenty of Foreign Capital in US Markets, for Now

Securities offered through the SouthState | DuncanWilliams 1) are not FDIC insured, 2) not guaranteed by any bank, and 3) may lose value including a possible loss of principal invested. SouthState | DuncanWilliams does not provide legal or tax advice. Recipients should consult with their own legal or tax professionals prior to making any decision with a legal or tax consequence. The information contained in the summary was obtained from various sources that SouthState | DuncanWilliams believes to be reliable, but we do not guarantee its accuracy or completeness. The information contained in the summary speaks only to the dates shown and is subject to change with notice. This summary is for informational purposes only and is not intended to provide a recommendation with respect to any security. In addition, this summary does not take into account the financial position or investment objectives of any specific investor. This is not an offer to sell or buy any securities product, nor should it be construed as investment advice or investment recommendations.