ADP Employment Report Hints At Ebbing Labor Market Momentum

ADP Employment Report Hints At Ebbing Labor Market Momentum

- After meandering in the red in early trading Treasuries are finding a bid once again after a soft ADP Employment Report hinted that the labor market is increasingly feeling the strains of the Fed’s rate-hiking campaign which plays into the market’s aggressive 2024 rate-cutting expectations (more on that below). Presently, the 10yr Treasury is yielding 4.15%, up 4/32nds in price and the 2yr Treasury is yielding 4.58%, unchanged on the day.

- Following on the heels of a lower-than-expected October JOLTS job openings print, this morning’s ADP Employment Change Report for November also was below expectations, adding further hints that the labor market is undoubtedly feeling the effects of the 500+ bps in rate hikes. Per ADP, private sector jobs increased 103 thousand in November vs. 130 thousand expected and 106 thousand in October, which was revised down from 113 thousand originally reported. Lately, the ADP hasn’t been a great predictor of what BLS will tell us, but it did call the October softness correctly so perhaps it gets a little more respect this month. Expectations are that Friday’s BLS jobs report will print 160 thousand private sector jobs vs. 99 thousand in October as formerly striking workers returned to their positions. Anything south of that will embolden the market to hold firm on its rate-cutting expectations as early as March/May next year.

- With the labor market showing signs that momentum is ebbing, inflation is also trending in the right direction for the Fed. This morning, the final revision to third quarter productivity came in better than previously estimated with productivity increasing at a 5.2% pace vs. the earlier estimate of 4.7% and 4.9% expected. One has to travel back to the third quarter 2020, and the rebound from lockdowns, to find a higher productivity number. That increased productivity lowered unit labor costs by -1.2% vs. -0.8% in the prior estimate and -0.9% expected. That implies higher profits for producers and/or lower costs passed on to consumers.

- Relatedly, both the CPI and PCE inflation series will see large 0.4% and 0.5% MoM prints rolling off in the next several months which, if replaced with 0.2% prints or lower, should allow for YoY levels to dip into 2-handle territory, which again will allow markets to remain aggressive in pricing in first-half 2024 price cuts.

- We’ll see in next week’s FOMC meeting, both in the comments and the updated dot plots, how much pushback they want to deliver to the market’s rate-cutting expectations, both in the volume and the timing. While they will undoubtedly take away that final 2023 rate hike forecasted in September, they will likely counter that with only one rate cut in 2024 vs. the two cuts in the September forecast. It’s too early for the Fed to declare victory so the higher-for-longer stance is likely to remain, but the stridency of that position will probably soften given the favorable trends in both the labor market and inflation.

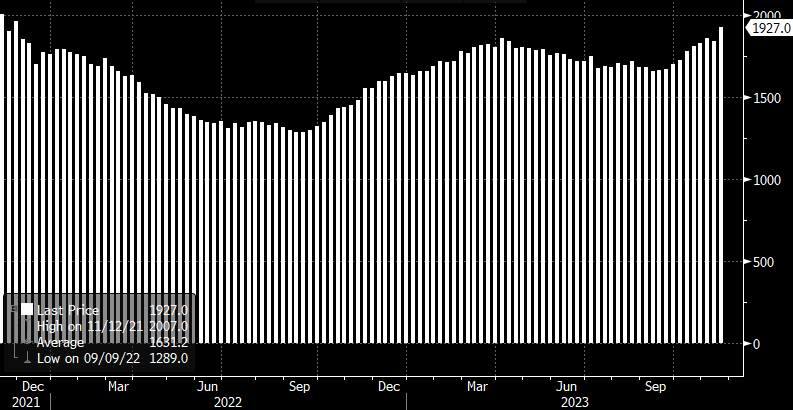

- Another indicator of potential flagging in labor market momentum will come tomorrow with the weekly initial jobless claims numbers. While the initial claims numbers have increased only modestly, last week’s continuing claims figure jumped to the highest level since late 2021 as the newly unemployed are apparently finding it tougher to secure new employment (see graph below). Thus, employers, while not aggressively cutting positions, appear reluctant to hire at the previous pace which is another real-time indication of easing tightness in the labor market.

Continuing Jobless Claims Hits 2-Year High – Hinting Employers Slowing Hiring Activity

Securities offered through the SouthState | DuncanWilliams 1) are not FDIC insured, 2) not guaranteed by any bank, and 3) may lose value including a possible loss of principal invested. SouthState | DuncanWilliams does not provide legal or tax advice. Recipients should consult with their own legal or tax professionals prior to making any decision with a legal or tax consequence. The information contained in the summary was obtained from various sources that SouthState | DuncanWilliams believes to be reliable, but we do not guarantee its accuracy or completeness. The information contained in the summary speaks only to the dates shown and is subject to change with notice. This summary is for informational purposes only and is not intended to provide a recommendation with respect to any security. In addition, this summary does not take into account the financial position or investment objectives of any specific investor. This is not an offer to sell or buy any securities product, nor should it be construed as investment advice or investment recommendations.