ADP Beats and Geo-Political Issues put Treasuries on the Back Foot

- With geo-political saber-rattling taking to the skies over Israel last night, reports that no major damage from the missile barrage has left the flight-to-safety trade wanting and Treasuries are on the back foot this morning. But with Israel pledging a retaliatory response the story is far from over. A somewhat positive ADP employment report (more on that below) also has Treasuries on the defensive so a nice dip-buying opportunity can be had by those looking to put some funds to work. Currently, the 10yr Treasury is yielding 3.81%, up 7bps on the day, while the 2yr is yielding 3.65%, up 4bps on the day.

- Second-tier employment numbers continue to roll in this week and the ADP Employment Change report for September beat expectations with 143 thousand new private sector jobs vs. 125 thousand forecast and 103 thousand in August (upwardly revised from 99 thousand). This points to a slightly better outlook for the BLS Nonfarm Payrolls report due on Friday. In that one, the private sector job growth is expected to be 125 thousand vs. 118 thousand in August. The ADP report has taken some grief in the past year for often varying widely from the BLS number, but with the usual downward revisions that follow in the BLS ADP has in many cases been unfairly criticized. Afterall, it receives data from over 10 million companies which is a larger sample size than the BLS Establishment Survey, so perhaps a little more respect is due ADP? I’m always a sucker for an underdog story.

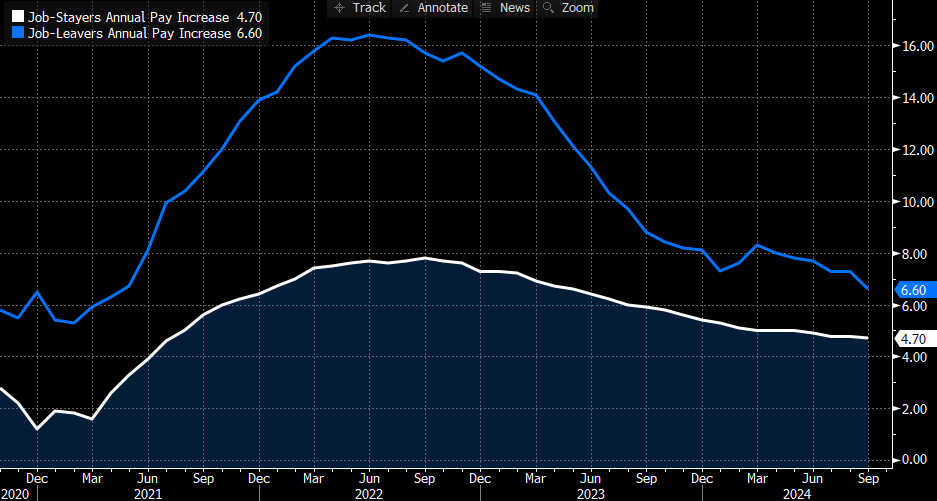

- Within ADP, the service sector produced 101 thousand new jobs while the goods producing sector was at 42 thousand. This is another sign that it’s the service side of the economy that is carrying the load, and that’s been going on for a while. Finally, job-stayers saw their annual pay increase by 4.7% while job-changers saw pay increase 6.6% (see graph below). Those levels, while healthy compared to BLS’ August Average Hourly Earnings at 3.8%, are trending lower and is another sign of some cooling in labor market momentum.

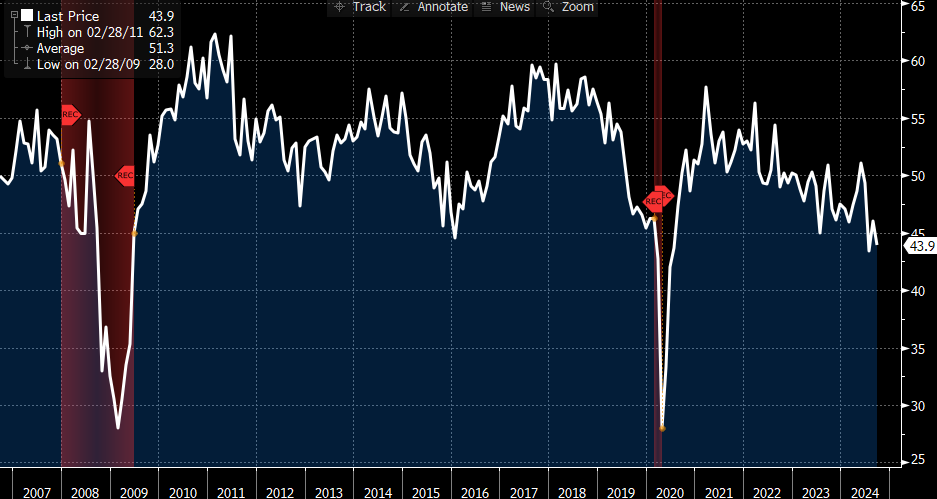

- The ISM Manufacturing Index yesterday saw the employment index dip to 43.9. Outside of the large drop to 43.4 in July it’s the lowest employment print since July 2020 (see second graph below). So, the story of a weak and rather listless manufacturing sector, certainly from the employment perspective, continues. This isn’t really a surprise to anyone, but it does signal no real up turn either.

- Those looking for another clue in their quest to find a weakening economy will get their chance tomorrow with the ISM Services Index for September. We’ve already seen the service side is doing the heavy lifting for the economy and the sector is expected to remain in expansionary territory with little change forecast at 51.7 vs. 51.5. The employment metric will get plenty of attention with markets looking for any signs of softening. In August, It held in expansionary territory, but just barely at 50.2. If it dips below 50 it could be one of the earliest indicators that the services-side is cooling which would add to the odds of a 50bps cut which are currently sitting at 35%.

- Of course, all these reports are just the appetizers until the main course of the BLS Nonfarm Payroll report on Friday. 150 thousand new jobs are expected vs. 142 thousand in August, with the unemployment rate unchanged at 4.2%. Average hourly earnings are expected to post a solid 0.3% MoM which would keep the YoY at 3.8%. If those numbers come to pass, it would certainly further diminish the odds of a 50bps

ADP Employment Change Report – Annual Wage Gains Still Strong But Slowing Source: Bloomberg

Source: Bloomberg

ISM Manufacturing Employment Index – Moves to Near 2020 Low Source: Bloomberg

Source: Bloomberg

Securities offered through the SouthState | DuncanWilliams 1) are not FDIC insured, 2) not guaranteed by any bank, and 3) may lose value including a possible loss of principal invested. SouthState | DuncanWilliams does not provide legal or tax advice. Recipients should consult with their own legal or tax professionals prior to making any decision with a legal or tax consequence. The information contained in the summary was obtained from various sources that SouthState | DuncanWilliams believes to be reliable, but we do not guarantee its accuracy or completeness. The information contained in the summary speaks only to the dates shown and is subject to change with notice. This summary is for informational purposes only and is not intended to provide a recommendation with respect to any security. In addition, this summary does not take into account the financial position or investment objectives of any specific investor. This is not an offer to sell or buy any securities product, nor should it be construed as investment advice or investment recommendations.