A Quiet Friday Awaits as Investors Look to Next Week’s Jobs Data

- A quiet start to Friday has Treasuries trading similarly while equities are finding a bit of profit-taking in play after a couple strong up days for stocks. The data calendar is limited and that has investors looking ahead to next week’s deluge of employment numbers, assuming the headlines from DC don’t upset the apple cart. Currently, the 10yr is yielding 4.27%, down 4 bps on the day, while the 2yr is yielding 3.79%, unchanged on the day.

- Federal Reserve Bank of Cleveland President Beth Hammack told CNBC yesterday the central bank could move as early as June if it has clear evidence of the economy’s direction. Meanwhile, Fed Governor Chris Waller similarly said he’d support rate cuts if President Trump’s tariffs start pushing up the unemployment rate. Recall, Hammack, in her first FOMC meeting in December dissented over the rate cut at that meeting, so she’s showing herself to be pragmatic regarding policy, while Waller continues in his recent role as willing to look through tariff-inspired price hikes and would approve rate cuts if he sees a slowdown in the labor market.

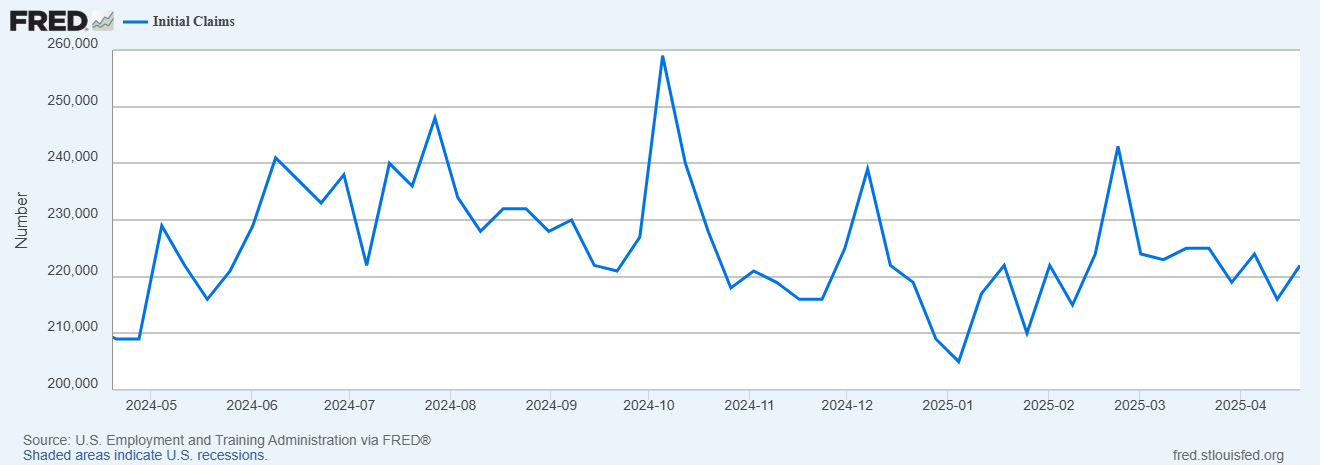

- The weekly jobless claim series continues to be docile, with no indication of an uptick in layoffs. Once again, it’s the divergence between soft survey data and better realized data. The advance figure for seasonally adjusted initial jobless claims for the week ending April 19 was 222,000, an increase of 6,000 from the previous week’s revised level and matching expectations. The previous week’s level was revised up by 1,000 from 215,000 to 216,000. The 4-week moving average was 220,250, a decrease of 750 from the previous week’s revised average. The previous week’s average was revised up by 250 from 220,750 to 221,000.

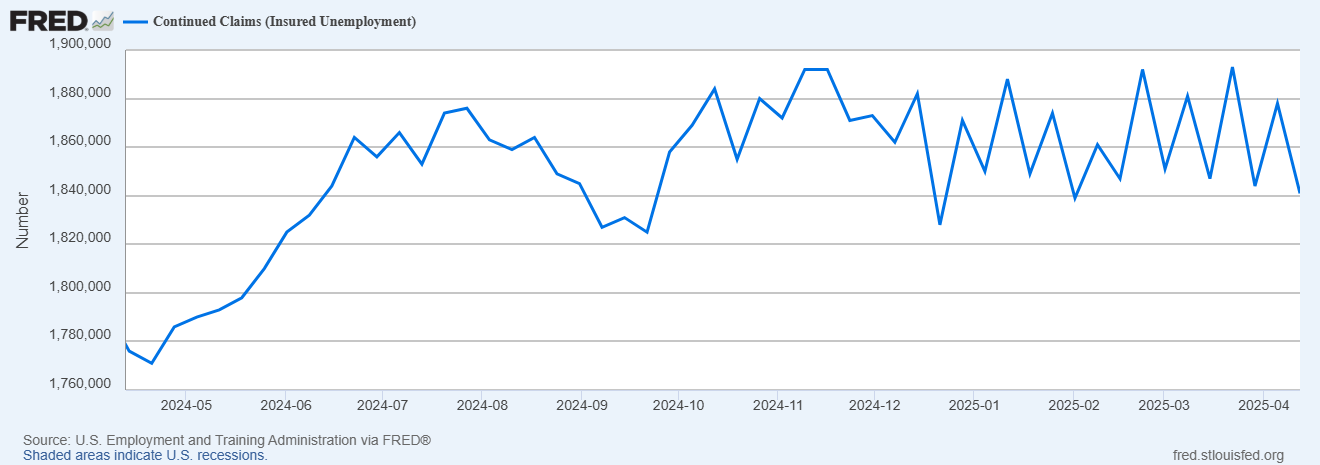

- The advance number for seasonally adjusted continuing unemployment claims during the week ending April 12 was 1,841,000, a decrease of 37,000 from the previous week’s revised level. The previous week’s level was revised down by 7,000 from 1,885,000 to 1,878,000. The 4-week moving average was 1,864,000, a decrease of 1,500 from the previous week’s revised average. The previous week’s average was revised down by 1,750 from 1,867,250 to 1,865,500.

- Meanwhile, the preliminary look at durable goods orders for March was pretty docile as well, after excluding a surge in aircraft orders. New orders for manufactured durable goods in March, up three consecutive months, increased $26.6 billion or 9.2% to $315.7 billion, easily beating the 2.0% forecast. This followed a 0.9% February increase. Excluding transportation, new orders were unchanged vs. 0.3% expected. Excluding defense, new orders increased 10.4%, again driven by aircraft orders.

- Shipments of manufactured durable goods in March, up four consecutive months, increased $0.2 billion or 0.1% to $293.0 billion. This followed a 1.3% February increase. Primary metals, up six of the last seven months, led the increase, $0.2 billion or 0.8% to $27.8 billion. In summary, a good month for Boeing, but for everyone else it was a modest month of output and shipments. Again, no signs of imminent collapse but nothing to write home about either.

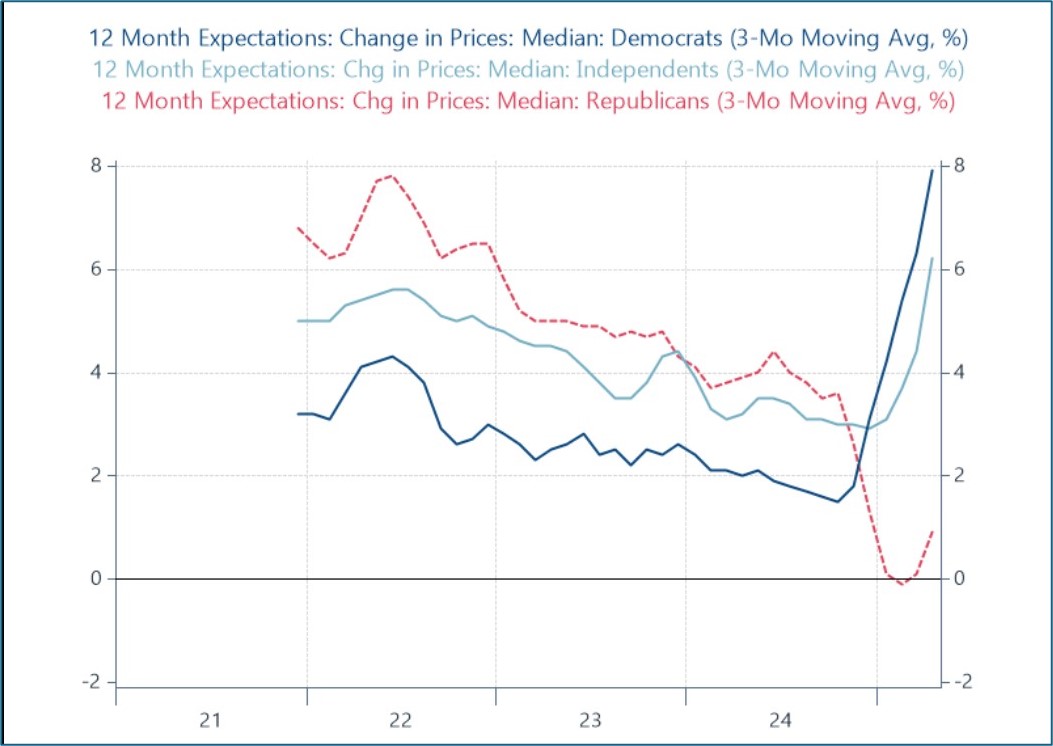

- Later this morning, the final look at April’s University of Michigan Sentiment Survey will be released where the preliminary report last week showed a spike in inflation expectations (6.7% 1yr ahead, and 4.4% 5-10yr ahead). We’ll see if those levels moderate in the final report, but other consumer surveys (namely from the New York Fed) noted tariff-derived increases in inflation expectations, but they were well below the levels reported in this report. The market is picking up on a political bent to the University of Michigan survey that seems to be driving some of the extremes in sentiment (see graph below); thus, it’s being discounted some compared to other surveys.

- While we wait for next week’s employment numbers, the S&P Global PMIs released on Wednesday indicated the slowest pace of business activity since the end of 2023, even as sentiment among manufacturers and services providers remained modestly expansionary (>50). Within the details of the release, the observation was made that, “Tariffs are meanwhile being cited as the key cause of higher prices, though labor costs are also reportedly continuing to rise, causing companies to hike their selling prices at a pace not seen for over a year. In manufacturing, the rate of price increase is the steepest for nearly two-and-a-half years. These higher prices will inevitably feed through to higher consumer inflation, potentially limiting the scope for the Federal Reserve to reduce interest rates at a time when a slowing economy looks in need of a boost.”

- The Fed’s Beige Book, which will be the basis for the economic snapshot at the May FOMC meeting, noted increasing levels of uncertainty given the fluctuating tariff situation, but some contacts were already reporting preliminary price increases “in anticipation” of coming tariffs.

University of Michigan Sentiment Survey – 12mo Inflation Expectations by Political Party Affiliation

Source: Univ. of Mich. Preliminary Sentiment Survey

Weekly Initial Jobless Claims – Not Much to See Here

Continuing Jobless Claims – Not Much to See Here Either

Securities offered through the SouthState | DuncanWilliams 1) are not FDIC insured, 2) not guaranteed by any bank, and 3) may lose value including a possible loss of principal invested. SouthState | DuncanWilliams does not provide legal or tax advice. Recipients should consult with their own legal or tax professionals prior to making any decision with a legal or tax consequence. The information contained in the summary was obtained from various sources that SouthState | DuncanWilliams believes to be reliable, but we do not guarantee its accuracy or completeness. The information contained in the summary speaks only to the dates shown and is subject to change with notice. This summary is for informational purposes only and is not intended to provide a recommendation with respect to any security. In addition, this summary does not take into account the financial position or investment objectives of any specific investor. This is not an offer to sell or buy any securities product, nor should it be construed as investment advice or investment recommendations.