A Dovish Pause, But Perhaps Not That Dovish

A Dovish Pause, But Perhaps Not That Dovish

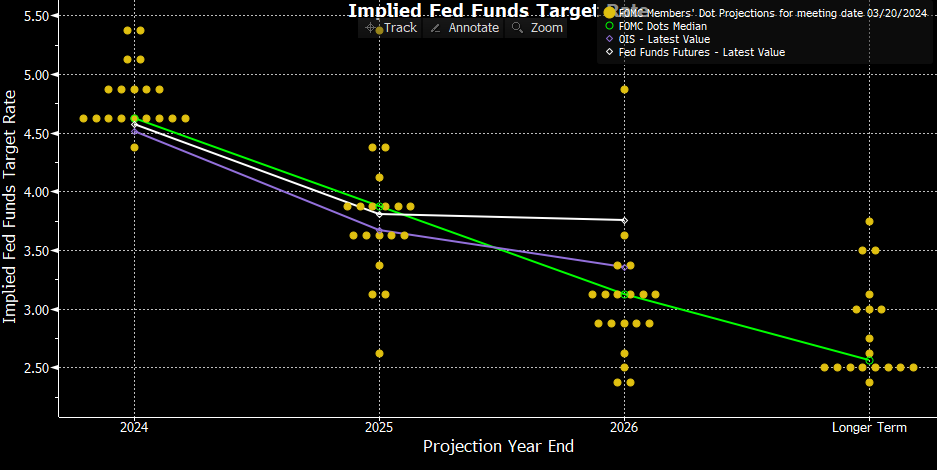

- With no new data on tap today, it gives us more time to pick over the FOMC meeting, and what we learned, and what we didn’t. First, the market took the Fed’s continued forecast of three rate cuts this year as a dovish signal and so stocks and bonds rallied. But, the Fed also reduced rate cuts in 2025 and 2026 from December’s expected four cuts to three. They also slightly raised the long-run dot from 2.50% to 2.625%. The market is apparently waving off the slower out year rate-cutting forecasts given the challenges (read: wrong) evident in previous forecasts.

- Also, we mentioned before the meeting that it would take only 2 of the 11 “dots” that had forecast three or more cuts in 2024 back in December to reduce their forecast which would shift the median to two cuts. Well, one dot did move above the median from December, so the three cut forecast this week is tenuous, at best. Also, only one dot foresees more than three cuts while December had several in the four, or more, cut forecast. So, while the market took the totality of the message to be dovish, Fed members may take issue with that interpretation.

- In addition, that slight upward move in the long-run dot provides a signal that officials are warming to the idea that the post-pandemic economy will be at a slightly higher cost plateau than pre-Covid. While it was a minimal move (from 2.5% to 2.625%), we had been waiting through several forecasts to see it move for the first time since 2019, and this week it finally did. Essentially, with a neutral rate moving higher, the degree of restrictiveness at the current rate becomes slightly less. Again, this is something the market isn’t going to trade on today, but it’s an important signal from the Fed and will no doubt bring speculation on whether the June forecast bumps it up again. If they do, those slower out year rate-cutting forecasts become more logical.

- Also contributing to the post-meeting rally was Powell’s refusal to express concern over the January and February inflation reports that were notably hotter-than-expected. While not relenting on getting core PCE eventually to 2.0%, he implied rate cuts wouldn’t have to wait for that goal to be accomplished. He also noted that they have greater confidence that Owners Equivalent Rent will continue to trend lower this year and at more than 25% of CPI (the single largest component), it will have a meaningful impact on inflation readings to come. He also acknowledged that tricky seasonal adjustments could have goosed numbers higher in January with a bit of an echo in February.

- Finally, Powell mentioned the committee began discussing the future of the quantitative tightening (QT) program and how to begin winding it down. Currently, QT is running off $60 billion/month in Treasuries and up to $35 billion/month in MBS. No details were offered up by Powell, and he said those details were not part of the discussion. The minutes will be gleaned to see what exactly was discussed. Projections from Wall Street have centered on tapering beginning in June or July with Treasury run-off cut to $30 billion/month with a goal of reducing the balance sheet to $6 trillion, or close to it. Expect more news on this at the May meeting, with cuts in the run-off beginning sometime in the summer.

Latest Fed Dot Plot – Still Three Cuts This Year, But Just Barely

Source: Bloomberg

Securities offered through the SouthState | DuncanWilliams 1) are not FDIC insured, 2) not guaranteed by any bank, and 3) may lose value including a possible loss of principal invested. SouthState | DuncanWilliams does not provide legal or tax advice. Recipients should consult with their own legal or tax professionals prior to making any decision with a legal or tax consequence. The information contained in the summary was obtained from various sources that SouthState | DuncanWilliams believes to be reliable, but we do not guarantee its accuracy or completeness. The information contained in the summary speaks only to the dates shown and is subject to change with notice. This summary is for informational purposes only and is not intended to provide a recommendation with respect to any security. In addition, this summary does not take into account the financial position or investment objectives of any specific investor. This is not an offer to sell or buy any securities product, nor should it be construed as investment advice or investment recommendations.