A Defensive Tone Opens a Busy Week

A Defensive Tone Opens a Busy Week

- They say stocks climb a wall of worry and that could be the case for Treasuries this week as several trip wires await investors. First, the after-effects of the solid jobs report from Friday will continue to reverberate, followed by CPI tomorrow. Then it’s the FOMC meeting on Wednesday and playing in the background is new supply in 3yr, 10yr, and 30yr bonds today and tomorrow. All of that is likely to keep traders on the defensive until the various event risks pass. Presently, the 10yr Treasury is yielding 4.26%, down 9/32nds in price and the 2yr Treasury is yielding 4.75%, down 2/32nds in price.

- This is probably the last consequential week of the year for the market with the final FOMC meeting for 2023 along with the November CPI and more Treasury supply for markets to contend with. Also, the Fed will have company this week with central bank rate decisions as the Bank of England and the ECB will hold rate-setting meetings.

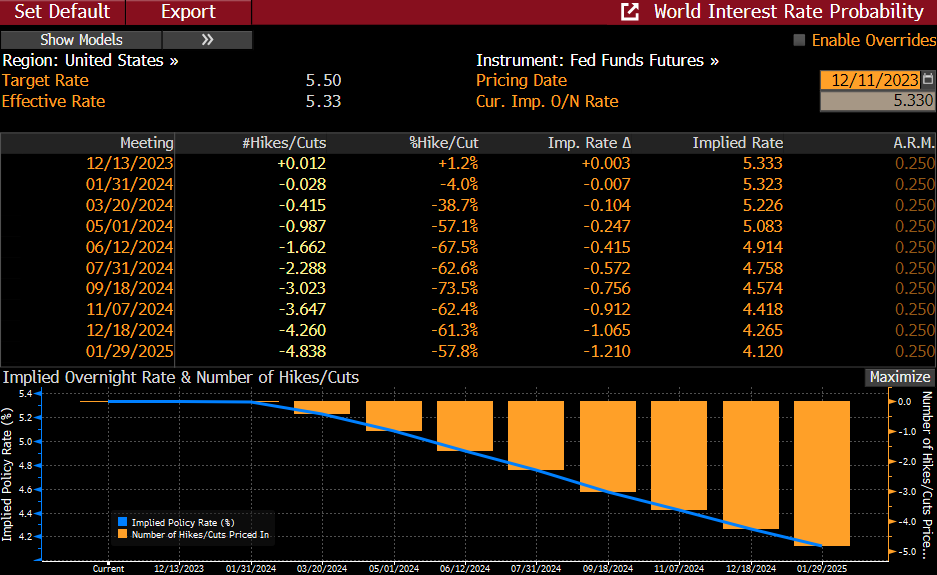

- We suspect the central banks messaging this week will be the same and that is rate hikes may be over, but that rate cut discussions are still a long way off. From the Fed’s perspective, the solid jobs report gives them ample room to continue the higher-for-longer theme and push back against market expectations of a rate cut as early as May. Given it’s a quarter-end meeting we’ll also get updated economic forecasts along with a refreshed dot plot of fed funds expectations. The question there is will the Fed keep the 50bps in 2024 rate cuts they projected in September, or will they reduce the cuts in the face of the still solid labor market and the lower terminal rate?

- Part of that rate forecasting calculus could be influenced in part by the November CPI, which is due tomorrow. Overall CPI is expected to be unchanged for a second straight month with the YoY rate dipping from 3.2% to 3.1%. Core, however, is expected to tick up to 0.3% vs. 0.2% in October with the YoY rate holding at 4.0%. The core rate will see large 0.4% and 0.5% MoM rates rolling off beginning next month so that will help move the YoY rate closer to a 2-handle if the new numbers print at 0.2% or less. A hotter-than-expected inflation read will play into the Fed’s higher-for-longer mantra and increase their pushback on the first-half 2024 rate cut expectations (see table below).

- PPI follows on Wednesday, so probably not consequential to the Fed’s rate decision, but the numbers are expected to be a tad hotter than the very cool October results. Overall PPI is expected to be unchanged vs. -0.5% in October with the YoY rate ticking down to 1.1% vs. 1.3% the prior month. PPI ex-food and energy is expected to tick up to 0.2% vs. unchanged in October but the YoY rate is expected to continue its drift lower to 2.2% vs. 2.4%. All-in-all, a docile read on wholesale inflation is expected and that could foretell another friendly read on PCE inflation later this month as some of the PCE series gets its inputs from PPI.

- Finally, retail sales for November will be on offer Thursday and will provide our first robust read on the consumer’s health for the month. Overall sales are expected to decrease -0.1% for the second straight month while sales ex-auto and gas are expected to tick up 0.2% from 0.1% in October. The so-called control group, which feeds directly into GDP, is expected to increase 0.2% for the second straight month. So, a decent month is expected with little evidence of a material slowing in spending but certainly at a lower level than was the case in the third quarter. The Atlanta Fed’s GDPNow forecast is for fourth quarter GDP to be 1.25%, reflecting in part the slowing in consumer spending from the torrid pace in the prior quarter.

Market Sees First Cut in May 2024 and 100bps for the Year – Expect the Fed to Push Back on That

Securities offered through the SouthState | DuncanWilliams 1) are not FDIC insured, 2) not guaranteed by any bank, and 3) may lose value including a possible loss of principal invested. SouthState | DuncanWilliams does not provide legal or tax advice. Recipients should consult with their own legal or tax professionals prior to making any decision with a legal or tax consequence. The information contained in the summary was obtained from various sources that SouthState | DuncanWilliams believes to be reliable, but we do not guarantee its accuracy or completeness. The information contained in the summary speaks only to the dates shown and is subject to change with notice. This summary is for informational purposes only and is not intended to provide a recommendation with respect to any security. In addition, this summary does not take into account the financial position or investment objectives of any specific investor. This is not an offer to sell or buy any securities product, nor should it be construed as investment advice or investment recommendations.