A Busy Week Awaits Investors

A Busy Week Awaits Investors

- Treasury prices are higher on a flight-to-safety trade following the weekend drone attack on US troops in Jordan. That geo-political risk is likely to spread giving Treasuries additional support heading into a week full of first-tier events, headlined by the FOMC meeting concluding on Wednesday. Presently, the 10yr Treasury is yielding 4.11%, up 8/32nds in price while the 2yr Treasury is yielding 4.33%, up 1/32nd in price.

- As mentioned, the FOMC rate decision on Wednesday headlines a busy week of first-tier reports, like January job and Treasury’s latest estimate of funding needs for the quarter. As for the meeting, we see the expected pause with little clarity on when the first cut will occur. The next meeting is in mid-March after another pair of inflation and employment reports, so the “data-dependent” phrase is likely to be heard on Wednesday. There is strong speculation they will begin to offer up some thoughts on winding down QT. We have surmised earlier that we get an announcement at this week’s meeting that it’s being studied, a more detailed announcement in March with the first reduction in run-off amounts set for the May 1 meeting.

- Away from the Fed, the January employment numbers will headline the economic reports this week. Expectations are for 180 thousand new jobs vs. 216 thousand in December. The unemployment rate is expected to tick up from 3.7% to 3.8%, with average hourly earnings up 0.3% MoM, matching December with the YoY pace unchanged at 4.1%. Recall, that December had an upside surprise in job growth, but with the trend in 2023 of downward adjustments, and some other seasonal noise in the numbers, some of the shine came off the report. In any event, the results will provide another large data point for the Fed to lean on as it begins to calibrate when rate cuts should begin.

- Recall too that the ADP Employment Change Report did nail the BLS numbers in December with 164 thousand private sector jobs which matched the BLS number. For January, ADP is expected to report 145 thousand new private sector jobs which is close to BLS expectations of 150 thousand. So, job growth appears to be slowing but will it be enough to spur a March rate cut? If job growth hangs in the mid-100k level, we think the Fed will continue with its patient pause approach. If it drops to the low 100k level, or less, then a March rate cut remains a possibility, assuming inflation prints continue to be well-behaved.

- Later this afternoon, the Treasury will update their expected funding needs for the quarter and that could generate some volatility following the announcement. The current estimate is $816 billion so anything above that could pressure yields higher, especially longer maturity securities. Recall that longer duration bonds suffered in August following the Treasury’s announcement then that exceeded earlier estimates.

- There are plenty of additional reports to keep your attention this week with JOLTS tomorrow (8.725m expected job openings vs. 8.790m in November), ISM Manufacturing on Thursday (47.2 expected vs. 47.4 in December), Employment Cost Index for the fourth quarter on Wednesday (1.0% vs. 1.1% third quarter), and the preliminary read on fourth quarter productivity (2.5% expected vs. 5.2% in third quarter). Those last two, ECI and productivity will be important in gauging wage and cost pressures, and the expectations point to rather docile reads which could offer the Fed one less argument in keeping rates at current levels.

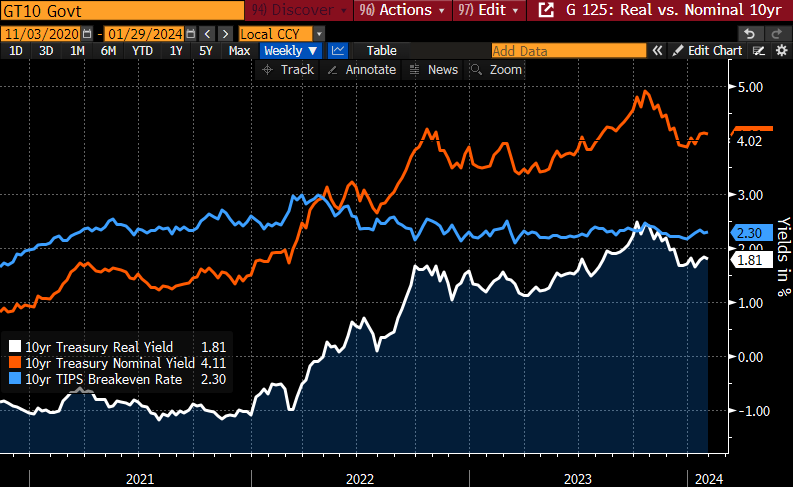

- In tune with that, the Wall Street Journal’s Fed whisperer Nick Timiraos had a weekend article arguing that even with the fed funds rate unchanged, because of dropping inflation expectations, the real cost of borrowing is increasing (see white line in graph). He expects that the language in the FOMC statement on Wednesday will shift from a tightening bias to a more neutral view, thereby setting the stage for a rate cut at a later meeting.

Even with the Fed in Pause Mode Lower Inflation Expectations are Increasing Real Yields

Securities offered through the SouthState | DuncanWilliams 1) are not FDIC insured, 2) not guaranteed by any bank, and 3) may lose value including a possible loss of principal invested. SouthState | DuncanWilliams does not provide legal or tax advice. Recipients should consult with their own legal or tax professionals prior to making any decision with a legal or tax consequence. The information contained in the summary was obtained from various sources that SouthState | DuncanWilliams believes to be reliable, but we do not guarantee its accuracy or completeness. The information contained in the summary speaks only to the dates shown and is subject to change with notice. This summary is for informational purposes only and is not intended to provide a recommendation with respect to any security. In addition, this summary does not take into account the financial position or investment objectives of any specific investor. This is not an offer to sell or buy any securities product, nor should it be construed as investment advice or investment recommendations.