Trump Wins and Treasury Yields Move Higher

- Well, that didn’t take long. With markets bracing for the possibility of days of election uncertainty, Trump won somewhat handily, and it looks like his coattails will bring along a sweep of Congress enabling little resistance to his most ambitious policy proposals. The kneejerk reaction to those campaign proposals is seen as inflationary and that has yields much higher this morning as a result. Currently, the 10yr Treasury is yielding 4.44%, up 15bps on the day, while the 2yr is yielding 4.27%, up 7bps on the day.

- With Trump winning the 47th Presidency, and with a sweep of Congress looking likely (some House races remain uncalled but it’s leaning for the Rs), investors are repricing in the face of a new policy gameplan about to happen. Of course, campaign proposals don’t always come to pass but with Trump promising sweeping tariffs, mass deportations, extending the 2017 tax cuts, the market is bracing for higher inflation and larger deficits. The kneejerk reaction is to push yields higher and that’s what we’re seeing in the early hours after the election.

- Of course, policies won’t be enacted until after the Jan. 20th inauguration, and even then, the impact will likely be a second half 2025 story. Regardless, the market is pricing in today what it sees coming down the road. And that doesn’t begin to consider the geo-political ramifications. With Trump’s noted antipathy towards NATO in his first term, it’s likely to resurface and create uncertainty with allies and enemies alike. The Russia/Ukraine conflict is also likely to see a shift in policy and that too will bring with it more uncertainty. Those are issues, however, for next year but they will be hanging over the collective psyche of the market for sure.

- Recall too, Trump has said he would exercise more oversight of the Federal Reserve in their policy discussions. Well, now he’ll have his chance. Fortunately, the Fed is in rate-cutting mode, presumably what a president would prefer, but will Trump urge them to cut larger and faster? That too could have implications for inflation not to mention growth.

- Meanwhile, back to the mundane matter of tomorrow’s FOMC rate decision. The Fed is widely expected to cut 25bps on Thursday and that won’t change with the election results in hand. But with no updated rate or economic forecasts until December the only possible drama will come from statements at the post-meeting press conference. Powell is probably not going to be divulging much in the way of market-moving comments. He surely be asked about the election results and Trump’s promised meddling, but we expect Powell will elect to keep comments in the non-controversial category. We continue to believe the Fed will cut another 25bps at the December meeting, but the data-dependent phrase is also likely to be heard more than once during the press conference.

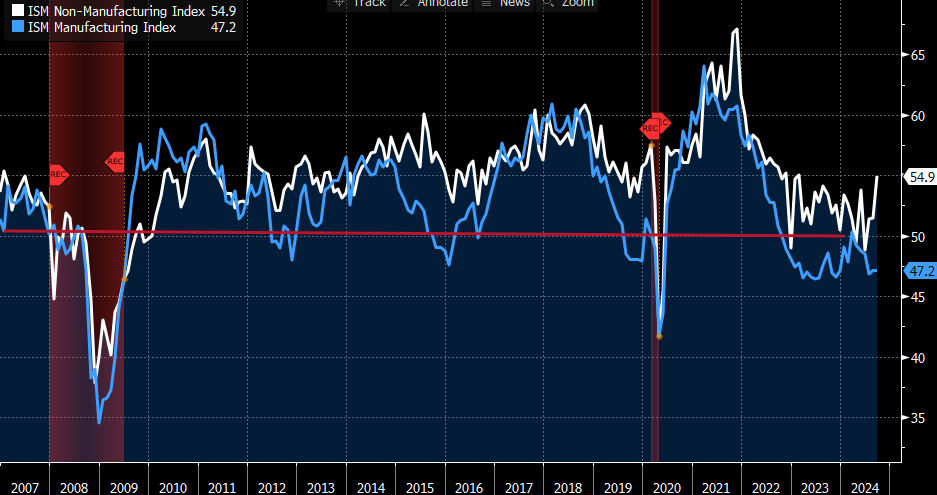

- Some of the sparse data we received this week was the October ISM Services Index released yesterday. It posted an impressive 56.0, the highest since July 2022 and well ahead of September’s 54.9. The prices paid component remained high but did slip from 59.4 to 58.1, while the employment component improved markedly from 48.1 to 53. The service side of the economy continues to carry the ball, and it doesn’t look to be needing a breather anytime soon, and that keeps moderate expansionary growth as the most likely scenario.

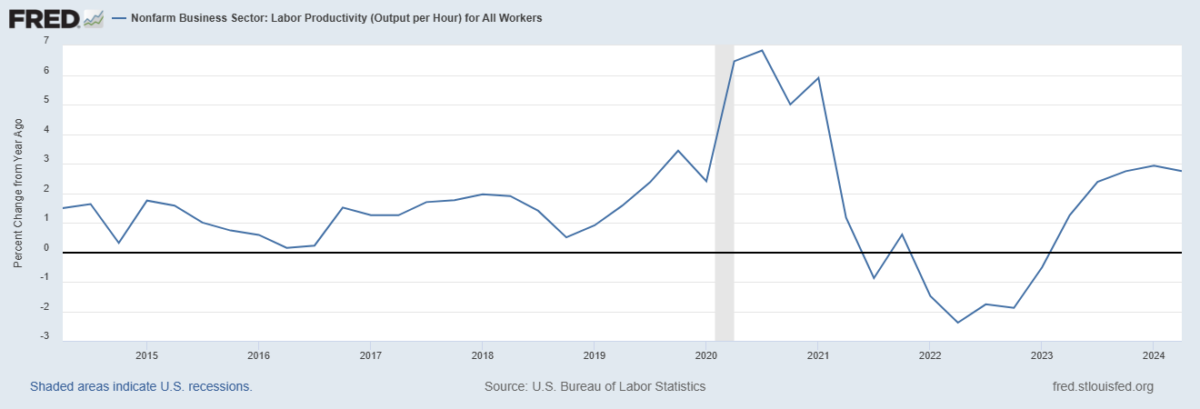

- We’ll be looking at tomorrow’s preliminary productivity numbers for the third quarter with the Bloomberg consensus calling for 2.5% and unit labor costs increasing only 1.0%. One way to keep wage gains from becoming too inflationary is to have people working more efficiently and the numbers have been turning up lately which is encouraging. Is it the adoption of AI that will herald a new productivity boom? There’s probably more to than that wherever its springing from, it is welcomed.

Improving Productivity Could Ease Wage Gain Cost Pressures

ISM Services Sector Remains in Expansionary Territory

Securities offered through the SouthState | DuncanWilliams 1) are not FDIC insured, 2) not guaranteed by any bank, and 3) may lose value including a possible loss of principal invested. SouthState | DuncanWilliams does not provide legal or tax advice. Recipients should consult with their own legal or tax professionals prior to making any decision with a legal or tax consequence. The information contained in the summary was obtained from various sources that SouthState | DuncanWilliams believes to be reliable, but we do not guarantee its accuracy or completeness. The information contained in the summary speaks only to the dates shown and is subject to change with notice. This summary is for informational purposes only and is not intended to provide a recommendation with respect to any security. In addition, this summary does not take into account the financial position or investment objectives of any specific investor. This is not an offer to sell or buy any securities product, nor should it be construed as investment advice or investment recommendations.