Bond Portfolio Trends: Second Quarter 2024

Examining Bond Portfolio Trends: Second Quarter 2024

Background

Beginning in May 2012, we started tracking portfolio trends of our bond accounting customers here at SouthState|DuncanWilliams. At present, we account for over 130 client portfolios with a combined book value of $13.8 billion (not including SouthState Bank’s portfolio), or $106 million average per portfolio. Twelve months earlier, the average portfolio size was $104 million, a minimal 2% increase over the year. Average portfolio size peaked at $111 million in November 2023.

Second Quarter Market Observations

- The second quarter of 2024 was characterized by some cooling in inflation numbers, and an economy and labor market that started to show tentative signs of slowing momentum. That moderation and cooler inflation numbers weren’t enough to overcome the first quarter’s surprisingly strong inflation prints. Thus, the updated rate and economic forecast from the FOMC June meeting called for only one rate cut in 2024, down from three cuts in the March forecast.

- Fed speak has welcomed the cooler inflation prints but continue to press the case that more of that is needed before having the confidence that inflation is trending to the 2% target. Part of that caution, and willingness to be patient, has been built around an economy and labor market that looked immune to rate hikes. That is starting to look less certain as the latest June data received to date is reflecting some softening in both the economy and the labor market. That could provoke a little more urgency at the Fed, which is pushing odds for a September rate cut above 70%.

- During the quarter, yields rose through April then fell in a jagged fashion in May, and much of June, returning to levels that prevailed as the quarter began. However, the strong May employment report, followed by the first presidential debate spurred higher yields as the quarter ended on the thought that Trump’s odds of winning the election improved markedly. Thus, yields ended the quarter about 15 – 20bp higher. With that backdrop, let’s turn our attention to changes in portfolio allocations during the past year.

Changes in Portfolio Allocations

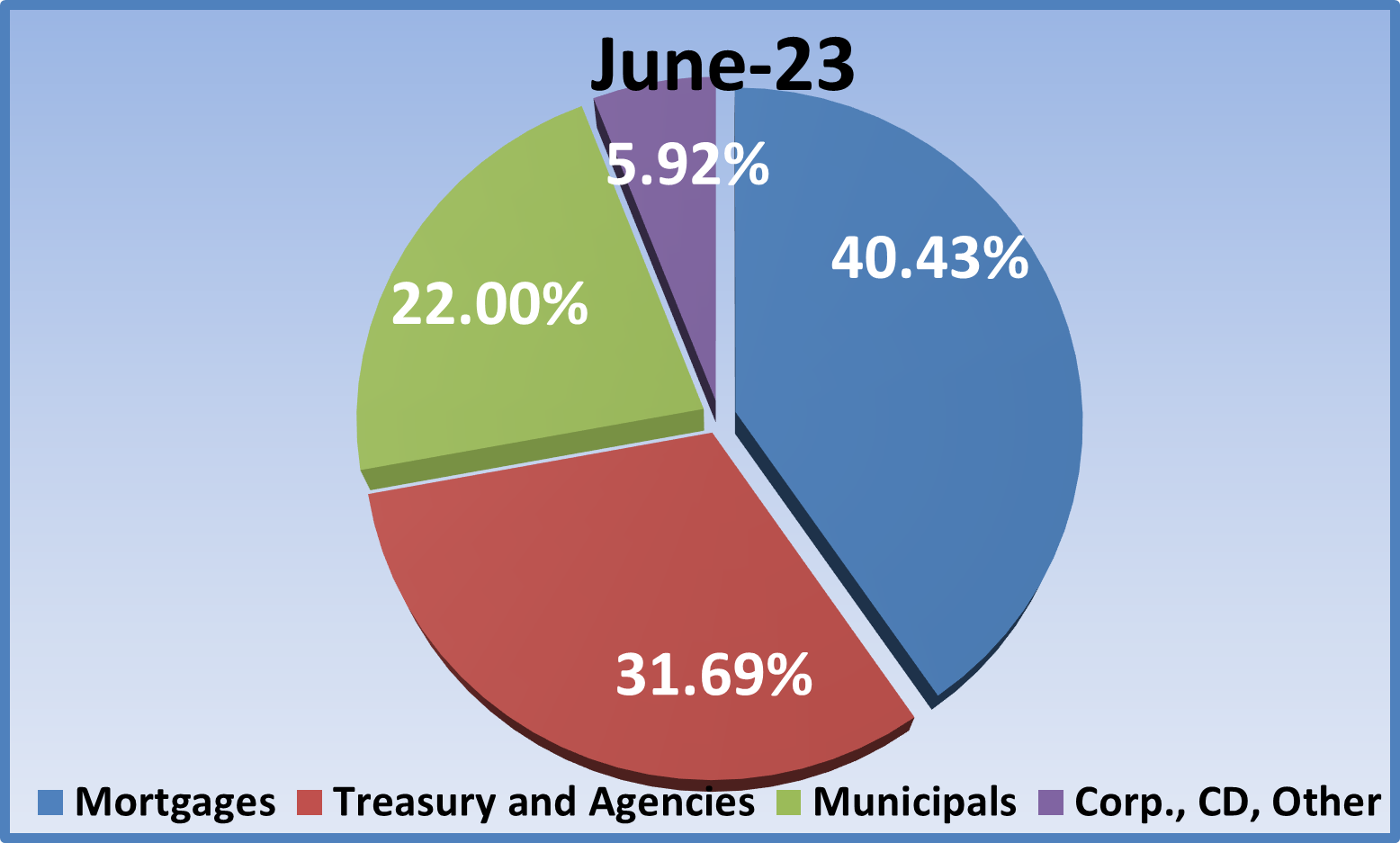

- Let’s begin our portfolio review by revisiting allocations a year ago as shown in the right pie chart below. The MBS/CMO sector comprised 40% of the portfolio, municipal allocations stood at 22%, Agency/Treasury investments were 32%, and the “Other” category) CDs, corporates, and other floaters) 5.9%.

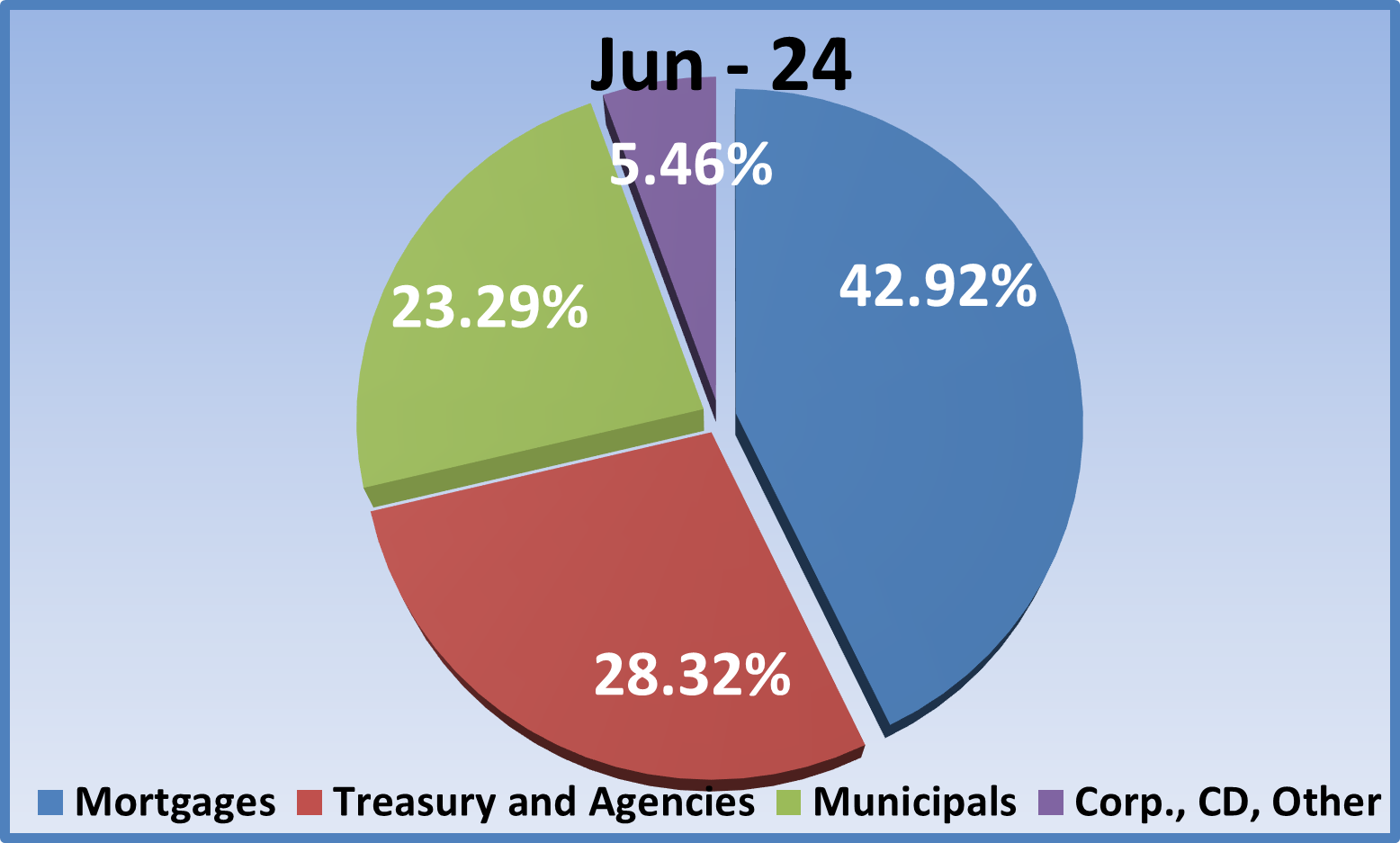

- Fast forward one year to June 30, 2024. The MBS/CMO sector comprised 43% of the portfolio, a 3% increase from last year. This repeats the experience of the previous two quarters which halted a six quarter trend of declining MBS allocations. Previous to the hiking cycle, MBS tended to lead portfolio investments by a wide margin.

- The decrease in municipal investments that had been a feature for much of 2023 stopped in the fourth quarter and that modest increase in allocation continued in the first quarter and again in the second with 23.3% in the sector (16.0% tax-free, 7.3% taxable). That is just over 1% above the year ago level. The stable investment allocation is an improvement over the run-off that had been a feature once the hiking cycle started in March 2022.

- The Agency/Treasury sector had been the one area that experienced increased allocations during the hiking cycle, but for the third straight quarter allocations declined from 31.7% a year ago to 28.3% this year as the MBS and muni sectors finally started to entice investors back to those sectors. The “Other” category was slightly smaller at 5.46% versus 5.92% a year ago with corporate bonds constituting more than 80% of the category.

Changes in Portfolio Performance

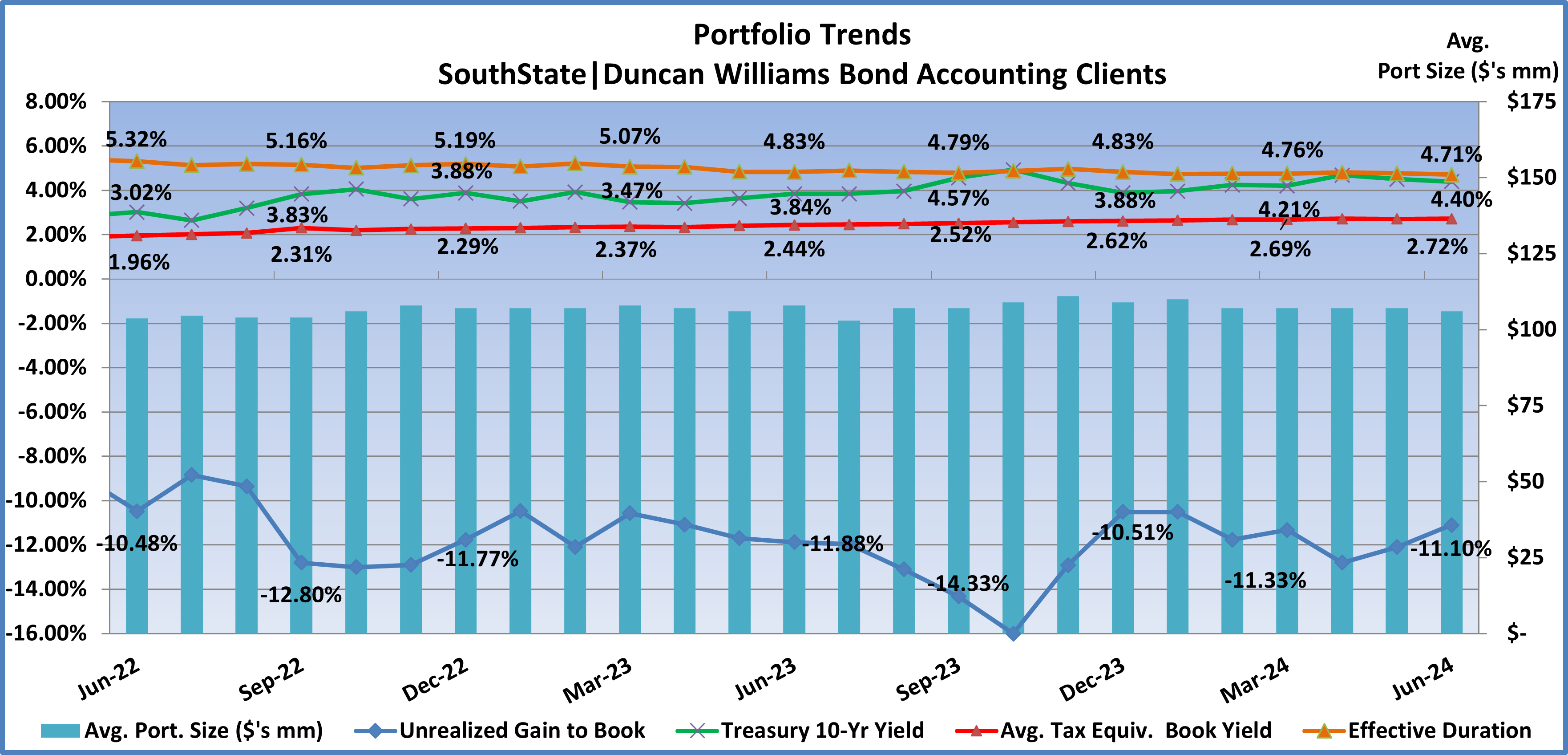

Now let’s look at portfolio performance trends. The graph below tracks average portfolio tax-equivalent book yield, duration, and unrealized gain/(loss) as a percent of book value. It also tracks 10-year Treasury yields and average portfolio size over the last two years.

- Portfolio yields averaged 2.44% (red line) a year ago. Yields slowly rose through the year as reinvestments were made at higher market yields, albeit on a modest basis. By the second quarter, yields increased 28bp over the prior twelve months to 2.72%, but improved only 3bp from the first quarter. We were typically seeing 7 to 8bp quarterly improvement in yields in 2023. With higher market yields in 2024, portfolio yields should continue increase as lower yielding legacy bonds are reinvested at higher market yields.

- 10-year Treasury yields (green line) began the year at 3.88%, quite the rally from when yields peaked mid-October at 4.99%, the cycle high. With the hot inflation readings during the first quarter, not to mention strong jobs numbers, 10yr yields trended higher during the first quarter while the second quarter saw cooler inflation numbers which created more volatility in yields but eventually ended up 19bps during the quarter. Yields are moving lower in early July as cool inflation readings meet with softer job and labor market data for June.

- Durations a year ago averaged 4.83 years and generally trended lower during the next twelve months ending June at 4.71 years as investments focused on shorter-duration securities than legacy bonds. The latest duration measure is the lowest since January 2022.

- The slight decrease in duration offset the slight increase in interest rates during the quarter resulting in a slightly smaller unrealized loss. Unrealized losses decreased from –11.33% to –11.10% as a percent of book. While still a sizeable number, it’s quite the improvement from the –16.00% cycle low in October.

Portfolio Purchases During the Second Quarter 2024

- New investments during the quarter decreased modestly from $683 million in the first quarter to $501 million, or $3.85 million on average per portfolio. For the tenth straight quarter, the Treasury/agency sector led purchases comprising 59% of the $501 million total ( 48% Treasury, 11% agency) and easily exceeded the legacy total of 28%. Next came 35% investments in MBS/CMO (26% MBS, 9% CMOs). The 35% investment slightly trailed the legacy 43% total. 30yr fixed-rate pools led MBS investments at 39% of the sector total and 14% of total investments. The municipal sector was lapped by the top two categories at just 4.5% of purchases, ( 3.4% tax-free, 1.1% taxable). The 4.5% in muni purchases compares to a 23% legacy muni allocation.

- Average tax-equivalent book yield for second quarter purchases was 5.14% versus 5.18% in the prior quarter. The average effective duration was 2.49 years versus 2.35 years in the prior quarter. Negative convexity was –0.21 versus –0.24 in the prior quarter. Compare those figures to the legacy portfolio book yield of 2.72% and effective duration of 4.71 years.

We will update this data again in October to track how allocations and performance characteristics trended in the summer months.

Securities offered through the SouthState | DuncanWilliams 1) are not FDIC insured, 2) not guaranteed by any bank, and 3) may lose value including a possible loss of principal invested. SouthState | DuncanWilliams does not provide legal or tax advice. Recipients should consult with their own legal or tax professionals prior to making any decision with a legal or tax consequence. The information contained in the summary was obtained from various sources that SouthState | DuncanWilliams believes to be reliable, but we do not guarantee its accuracy or completeness. The information contained in the summary speaks only to the dates shown and is subject to change with notice. This summary is for informational purposes only and is not intended to provide a recommendation with respect to any security. In addition, this summary does not take into account the financial position or investment objectives of any specific investor. This is not an offer to sell or buy any securities product, nor should it be construed as investment advice or investment recommendations.