2nd Quarter Productivity Improves but Continuing Claims Increase Too

- Treasury yields are a tad higher this morning as the last of the new Treasury supply was sold yesterday to tepid demand. The 30-year auction followed the trend of the 10-yr and 3-yr with mediocre at best results, but it’s interesting that the less than robust reception wasn’t met with more selling, and hence higher yields. It seems the market has taken the measure of new supply, the latest tariff news, combined with data indicating a downshifting in the economy and feels comfortable with yields at current levels, albeit on a slow summer Friday, devoid of any new releases. Currently, the 10yr Treasury is yielding 4.26%, up 2bps on the day, while the 2yr note yields 3.74%, up 1bp in early trading.

- Fed Governor Adriana Kugler, as previously announced, resigned today leaving President Trump with an open position to fill. Trump has reportedly decided to go in house with Stephan Miran, currently head of the Council of Economic Advisers at the White House. Kugler’s term expires in January so the appointment could be temporary, or Trump could decide to renominate Miran for the new 14-year term. Jerome Powell’s term as Chair expires next May, but his governor’s term doesn’t expire until January 2028. He hasn’t said whether he would stay on past his time as chair, but it is not unprecedented if he were to do so.

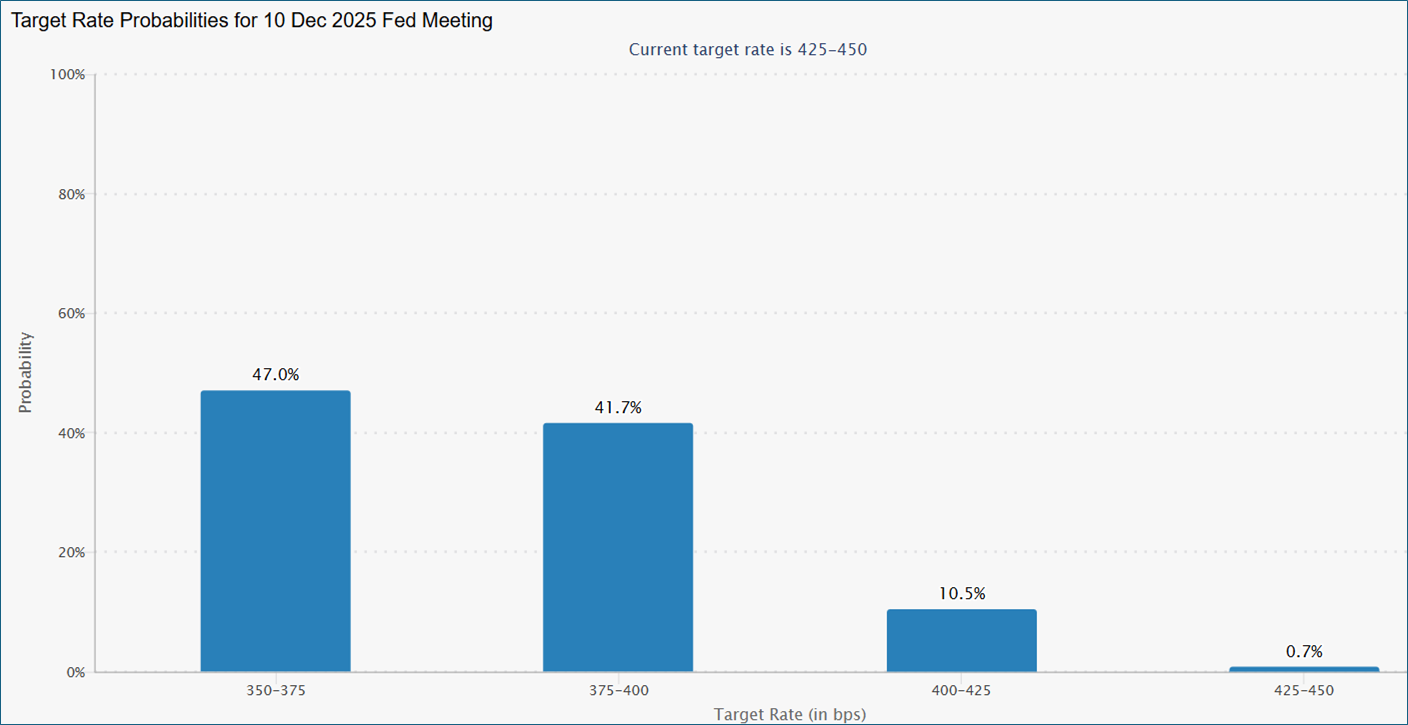

- Regardless, the Fed governing board will see some changes in the next year, but the FOMC will remain a 12-vote committee, so any shift in policy will likely be gradual. It’s a sure bet Miran will be on board with rate cuts in September, at the very least. The latest odds in the futures market have rate cuts approaching 75bps by year-end, but the odds were over 50% yesterday, so a little backsliding today. (see graph below).

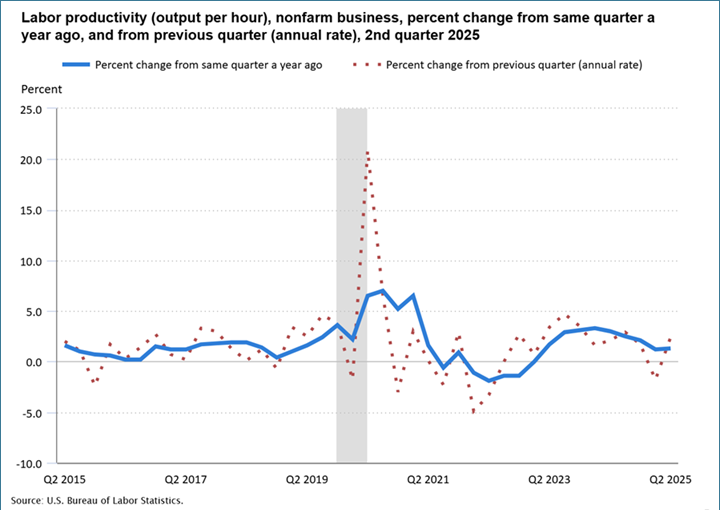

- The one positive report we received this week was yesterday’s 2nd quarter productivity numbers. Nonfarm business sector labor productivity increased 2.4% in the second quarter of 2025, on an annualized basis. Output increased 3.7% and hours worked increased 1.3% (3.7% – 1.3% = 2.4%). From the same quarter a year ago, nonfarm business sector labor productivity increased 1.3%. First quarter productivity was a disappointing -1.5% so the rebound was most welcome from both a growth and price pressure angle.

- Unit labor costs in the nonfarm business sector increased 1.6% in the second quarter, annualized, reflecting a 4.0% increase in hourly compensation and a 2.4% increase in productivity (4.0% – 2.4% = 1.6%). Unit labor costs have increased 2.6% over the last four quarters, so the improvement in the most recent quarter is a big positive for both economic growth and easing inflation pressures. There are two basic ways to grow an economy: employ more workers and/or make those workers more productive. So, with the rebound in 2nd quarter productivity both economic growth and limited price pressures will be welcomed by investors and the Fed. Productivity often draws blank stares when it’s discussed, but it really is the secret sauce to above-trend economic performance.

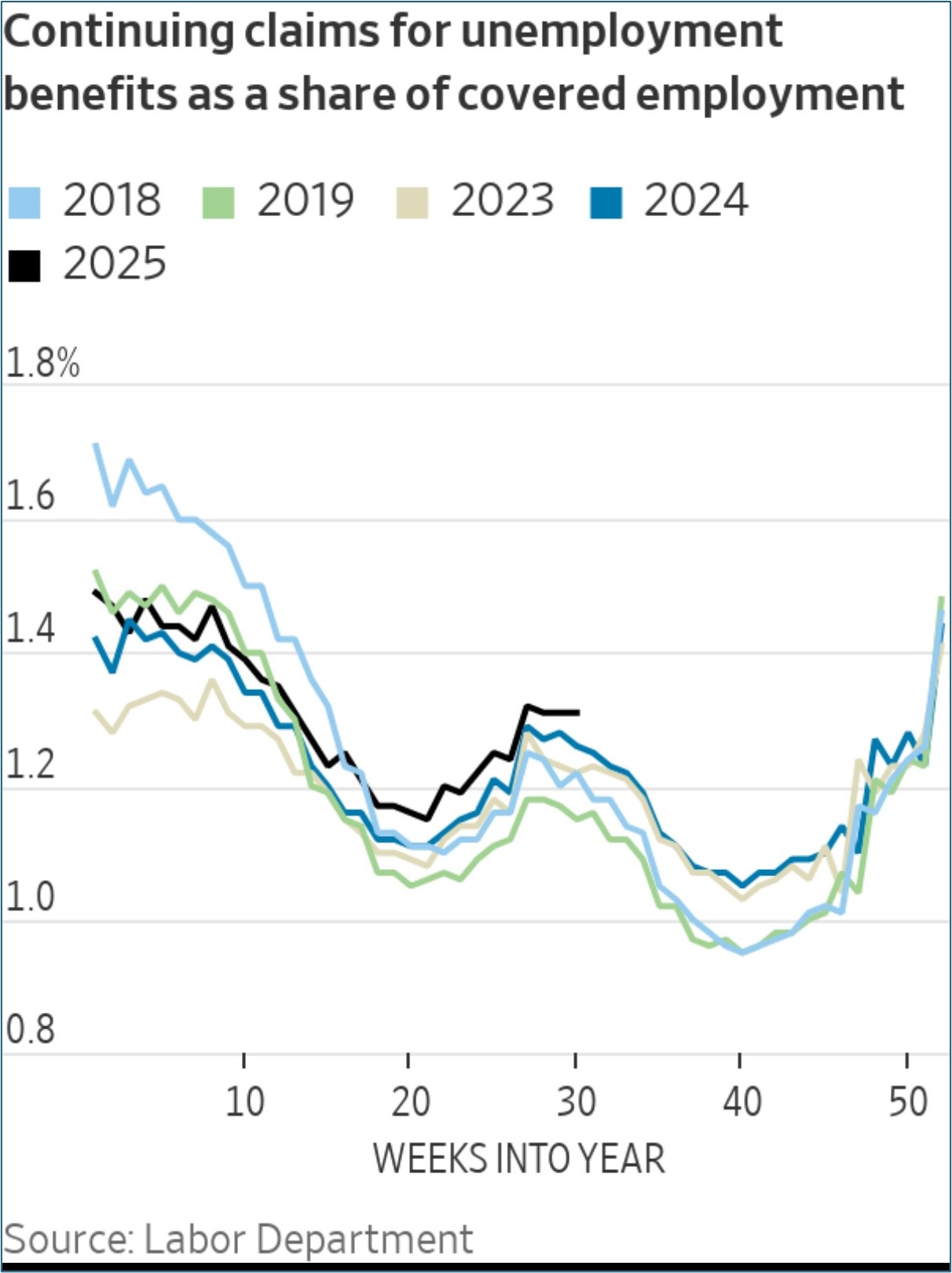

- Back to the mundane world of econ news, in the week ending August 2 initial jobless claims increased 7,000 to 226,000, from the previous week’s revised level of 219,000 (from 218,000). The bigger news is in the seasonally adjusted continuing claims figures. For the week ending July 26 claims totaled 1,974,000, an increase of 38,000 from the previous week’s revised level. This is the highest continuing claims level since November 6, 2021, when it was 2,041,000. The previous week’s level was revised down by 10,000 from 1,946,000 to 1,936,000.

- Thus, the trend remains the same: low-hire, low-fire seems the order of the day in 2025. For the Fed, this is actually somewhat fortunate as the slowdown in hiring, as evidenced by the recent jobs numbers, is being met with a reduction in labor supply. Thus, while hiring remains muted, the labor force is stagnating as well. This eases pressure on the unemployment rate which will allow the Fed to consider rate cuts despite inflation remaining above the 2.0% target with a decent chance to drift higher in coming months.

- Yesterday, the NY Federal released the July 2025 Survey of Consumer Expectations, which showed household inflation expectations increased at the short horizon (1yr at 3.1% from 3.0%) and longer-term as well (5yrs and greater at 2.9% from 2.6%). Expectations were steady at 3.0% for the 3yr horizon. Consumers also expect smaller growth in their tax payments and are more optimistic about their household financial situations. Expectations about the labor market were mixed with consumers reporting greater likelihoods of losing and finding jobs, and a lower likelihood of a rise in overall unemployment. The survey was fielded from July 1 through July 31, 2025. The full report can be found here.

Futures Market Continues to See Decent Odds of 75bps in Cuts by Year-End

2nd Quarter Productivity Improved Markedly From 1st Quarter’s Disappointment

Continuing Unemployment Claims Trending Above Recent History

Securities offered through the SouthState | DuncanWilliams 1) are not FDIC insured, 2) not guaranteed by any bank, and 3) may lose value including a possible loss of principal invested. SouthState | DuncanWilliams does not provide legal or tax advice. Recipients should consult with their own legal or tax professionals prior to making any decision with a legal or tax consequence. The information contained in the summary was obtained from various sources that SouthState | DuncanWilliams believes to be reliable, but we do not guarantee its accuracy or completeness. The information contained in the summary speaks only to the dates shown and is subject to change with notice. This summary is for informational purposes only and is not intended to provide a recommendation with respect to any security. In addition, this summary does not take into account the financial position or investment objectives of any specific investor. This is not an offer to sell or buy any securities product, nor should it be construed as investment advice or investment recommendations.